Okay, the million dollar question and yes, I'm already well invested in a wide range of investments besides this cash.

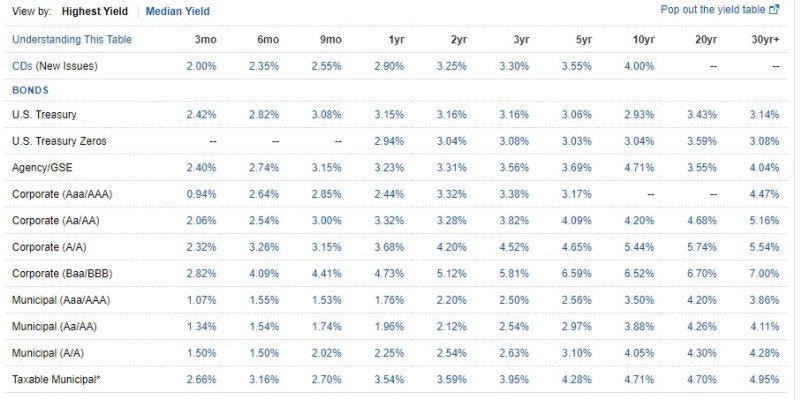

I currently have 3 large CD's ($100k+) that are going to renewal in the coming weeks. Currently rates are hovering around 2.5% for online banks (Capital One) but we all know rates are heading up in the coming weeks and even months.

I can certainly keep these CD's in lower paying liquid accounts such as a MM or savings until thing reach a plateau, but of course I'll be losing money on these lower rates.

Any words of wisdom or suggestions in the timing or locking-in of these CD's? I also fully realize that once I lock-in a CD I have the option of simply paying an early withdrawal penalty which many times makes perfect sense.

Realistically, CD rates will be in the 3% or higher range by next month at this time.

I currently have 3 large CD's ($100k+) that are going to renewal in the coming weeks. Currently rates are hovering around 2.5% for online banks (Capital One) but we all know rates are heading up in the coming weeks and even months.

I can certainly keep these CD's in lower paying liquid accounts such as a MM or savings until thing reach a plateau, but of course I'll be losing money on these lower rates.

Any words of wisdom or suggestions in the timing or locking-in of these CD's? I also fully realize that once I lock-in a CD I have the option of simply paying an early withdrawal penalty which many times makes perfect sense.

Realistically, CD rates will be in the 3% or higher range by next month at this time.