So what exactly would be your rules to purchase it? I always thought of the hurdle as being all or nothing, yes. I.e., if the value of ur portfolio is less than or equal to the cost of annuity to cover your expenses, the annuities. So how do u do it otherwise?

Sent from my iPad using Early Retirement Forum

First, thanks for asking this question. It's been a year or so since I evaluated this problem, and your question prompted me to go back to the Fullmer paper and Otar's book that are the basis of this part of our personal strategy.

The short answer is that, I will use two rules:

1. Otar's "Zone Strategy"

2. Fullmer's "Annuitization Hurdle" approach

With a reasonably balanced portfolio (say 60/40), you will almost certainly have adequate reaction time to (partially or fully) annuitize using these rules, before your assets are inadequate (inadequate=total annuitization of portfolio will not provide required income).

1. Using Otar's "Zone Strategy", you would be able to partially annuitize, with the ability to build an annuity ladder, if your assets moved from the "green" zone (abundant savings) into the "grey" zone (partial annuitization recommended), and well before the "red" zone (total annuitization required). Here's an example:

- 65yo single male w/ $2.7M portfolio (AA=60/40).

- Needs $100k/yr income from portfolio.

- With these numbers, he is barely in the "green" zone

- The S&P500 would have to drop >40% before he's in the "red" zone (total annuitization required)

- Therefore, he could partially annuitize as appropriate for his situation*, during any portfolio drop <40%.

* A key factor is how much other guaranteed income (SS, pensions, etc.) he has

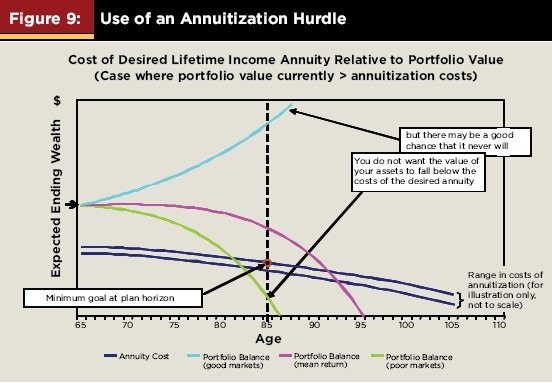

2. Using Fullmer's "Annuitization Hurdle" approach is similar to what's above. You track portfolio value, on a regular basis, against the amount required to annuitize, and would partially (or wholly) annuitize based on your personal situation. There's a nice curve that illustrates this but, I can't seem to paste it here. I'll include it in another post if I can figure out how to copy/paste it here.

Hope this helps. Feel free to PM me if you have other questions or just want to discuss these concepts; being prompted to test my own plans is a healthy thing.