firemediceric

Recycles dryer sheets

- Joined

- Aug 9, 2017

- Messages

- 207

Advice on the wisdom of pursuing a TFRA? I had never heard of them until the other day while surfing the internet. I'm sure some algorithm made sure to put the enticing information on my screen.

At https://smartasset.com/retirement/tfra-retirement-account I read that it's "A tax-free retirement account or Section 7702 plan funded through a permanent cash value life insurance policy." "funded with after-tax dollars, similar to the way you’d fund a Roth IRA. Cash value in the policy grows tax-deferred and policy owners can take out tax-free loans from that cash value during their lifetime. The amount of cash value that accrues inside the policy can depend on the underlying investment strategy."

From https://www.insurancegeek.com/retirement/tfra/ I read "They have many advantages compared to a 401K and Traditional IRA. Mostly the fact that you can not lose money and they are not directly invested in the market."

That makes me wonder if it's just an annuity by another name?

A snapshot of what was proposed to me based on my statement of only a $20k annual goal:

At https://smartasset.com/retirement/tfra-retirement-account I read that it's "A tax-free retirement account or Section 7702 plan funded through a permanent cash value life insurance policy." "funded with after-tax dollars, similar to the way you’d fund a Roth IRA. Cash value in the policy grows tax-deferred and policy owners can take out tax-free loans from that cash value during their lifetime. The amount of cash value that accrues inside the policy can depend on the underlying investment strategy."

From https://www.insurancegeek.com/retirement/tfra/ I read "They have many advantages compared to a 401K and Traditional IRA. Mostly the fact that you can not lose money and they are not directly invested in the market."

That makes me wonder if it's just an annuity by another name?

A snapshot of what was proposed to me based on my statement of only a $20k annual goal:

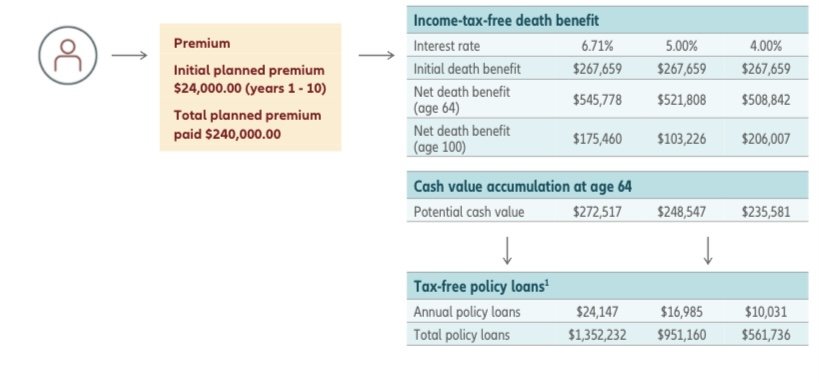

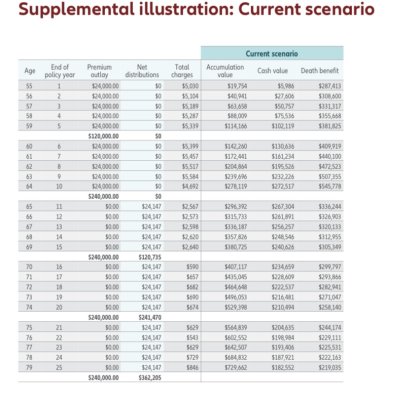

[FONT=Lato, Tahoma, Verdana, Segoe, sans-serif]"Thanks for reaching out with interest in a LIRP. I have attached some illustrations to show you how much you need to invest to meet your target retirement income goal of $20,000.[/FONT]

[FONT=Lato, Tahoma, Verdana, Segoe, sans-serif]Scenario 1[/FONT]

[FONT=Lato, Tahoma, Verdana, Segoe, sans-serif]Scenario 1[/FONT]

- [FONT=Lato, Tahoma, Verdana, Segoe, sans-serif]Illustrated Income - $24,147[/FONT]

- [FONT=Lato, Tahoma, Verdana, Segoe, sans-serif]Income Start Year - Age 65[/FONT]

- [FONT=Lato, Tahoma, Verdana, Segoe, sans-serif]Initial Planned Premium - $24,000[/FONT]

- [FONT=Lato, Tahoma, Verdana, Segoe, sans-serif]Day One Death Benefit - $267,659[/FONT]

Scenario 2

- Illustrated Income - $987

- Income Start Year - Age 60

- Initial Planned Premium - $6,000

- Day One Death Benefit - $100,000