NextInLine

Recycles dryer sheets

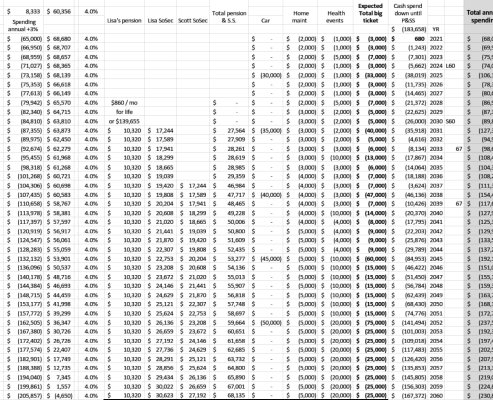

DW and I are 50. We plan to retire in 8 years at age 58. My job will pay decent pension and 75% health insurance cost. We would like to claim social security at 65. DW's work history is minimal for her to claim SS on her own. She will take spousal benefit according to my work history. I have 2 children and they should be done with college by 2027 (finger crossed). I have set aside 529 fund for their college cost. My house is paid off in 2015. We both are healthy and have active life style.

We LBYM and have saved more than 50% of our income.

Here is our finance situation and would like to have feedback on how to withdraw to maximize tax efficient.

401K – current balance $700,000. Annual contribution plus employer matching: $32K.

Roth IRA - current balance $150,000. Annual contribution $14,000

Taxable account- current balance $500,000. Annual contribution $24,000

We invest in passive index funds 80/20 AA and will scale back to 60/40 as we get close to target date of 2028. With conservative estimation by the time we retire my saving should have:

401K - $1M

Roth - $300K

Taxable - $700K

Every few years, I have counted every dollar we spent on entire year and our budget is very consistent of about $60k/year including health insurance.

My pension will pay close to $60K annually. That will cover our current cost of living. I’d like to withdraw $60K (3% SWR) from those 3 accounts to enjoy our retirement dream of traveling and doing good causes. When we claim SS at age 65, SS would pay at least $36K/year for both of us.

Many of you FIRE’d have similar savings structure. What is your withdrawal strategy from 401K/Roth/Taxable to maximize tax efficient? Appreciate feedback.

We LBYM and have saved more than 50% of our income.

Here is our finance situation and would like to have feedback on how to withdraw to maximize tax efficient.

401K – current balance $700,000. Annual contribution plus employer matching: $32K.

Roth IRA - current balance $150,000. Annual contribution $14,000

Taxable account- current balance $500,000. Annual contribution $24,000

We invest in passive index funds 80/20 AA and will scale back to 60/40 as we get close to target date of 2028. With conservative estimation by the time we retire my saving should have:

401K - $1M

Roth - $300K

Taxable - $700K

Every few years, I have counted every dollar we spent on entire year and our budget is very consistent of about $60k/year including health insurance.

My pension will pay close to $60K annually. That will cover our current cost of living. I’d like to withdraw $60K (3% SWR) from those 3 accounts to enjoy our retirement dream of traveling and doing good causes. When we claim SS at age 65, SS would pay at least $36K/year for both of us.

Many of you FIRE’d have similar savings structure. What is your withdrawal strategy from 401K/Roth/Taxable to maximize tax efficient? Appreciate feedback.

Last edited: