street

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 30, 2016

- Messages

- 9,583

So, I have another unintelligent question. With the young investors that have company payroll deduction for mutual/index funds how are they doing for growth?

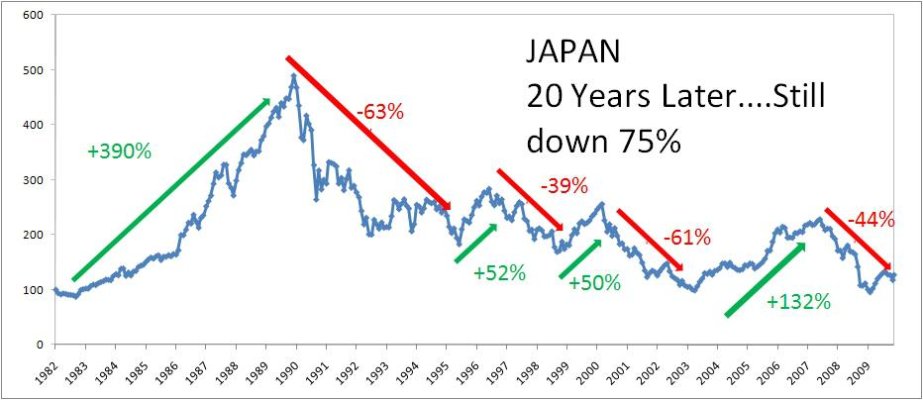

With high markets the cost of stocks is higher than in low market times. So, buying high and market stays high, are they having much growth of wealth? I do know it is all relative for the long haul but for someone wanting to retire in a couple years down the road, what would be your view on that portfolio?

With high markets the cost of stocks is higher than in low market times. So, buying high and market stays high, are they having much growth of wealth? I do know it is all relative for the long haul but for someone wanting to retire in a couple years down the road, what would be your view on that portfolio?