I'm hoping for an early out offer next year when I turn 50 and have 20 years of service with the Federal Government but I realize that offer may never come. I have run the numbers and I will be able to retire without it. I may have no other choice but to resign but that scares the *ell out of me. Just wondering how others over came their "what if" fears and finally made that leap into retirement?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Able to retire but how to get the guts to resign?

- Thread starter Vera

- Start date

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

It took me a year from when I planned to retire to when I actually did. I'd guess the answer is different for everyone, depending on:

- How comfortable are you that your nest egg is adequate?

- Some people are comfortable with an 80% probability of success, others want twice as much as needed to reach (theoretical) 100%.

- Some are fine with a 5-6% WR, others shoot at low as 2%, maybe even less.

- What kind of investment returns and inflation do you really expect in the future? Same as the past 100 years? More? Less?

- How much floor income to you have established; pensions, annuities, Soc Sec, other income? COLA'd?

- What do you expect of Soc Sec, same as current projections or a reduction?

- What do you expect your retirement spending to look like?

- If your spending will be reduced, try living on that amount for a year or more before retiring to be sure. Might change your mind about what's realistic.

- What are your plans for health insurance? Covered? At what cost & inflation (HI costs have been rising faster than inflation overall).

- Medicare? PPACA?

- What do you expect taxes will be like in the future? Same or higher?

- How much do you like/dislike your job and the people you work with?

- If you like what you do and the people you work with, reaching FI isn't a reason to retire/quit IMO unless you have other things that you'd like to do more.

- Or you can start another career if you don't like your current career, FI or not.

- For some people, their career/job title is a big part of their identity.

- Have you thought about 'what you'll do all day' once retired? While some people easily fill their time with other activities, some people miss the structure and become bored or even depressed after the initial novelty of retiring wears thin. I suspect most people are somewhere in between the two extremes. I'd encourage every potential retiree to at least give retirement activities some serious thought before pulling the plug.

Last edited:

We lived off our expected retirement budget for three years prior. That gave us confidence the budget was good and the assets would hold. Market fell at the beginning of our test period. We were nervous, but held to plan and are fine.

We also budgeted for 75% social security and to take that at 62 (expect since we are now both over 55 that we will get a higher percentage, and really do not plan to take it till full returement for DH and 70 for me).

We also budgeted for 75% social security and to take that at 62 (expect since we are now both over 55 that we will get a higher percentage, and really do not plan to take it till full returement for DH and 70 for me).

scrabbler1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 20, 2009

- Messages

- 6,699

It was a little scary for me back in late 2008 but when the last of the several pieces of my ER plan finally fell into place, I said to myself, "Wow, I can finally DO this." I took a deep breath, ran the numbers a few more times to make sure I had not missed anything, wrote my resignation letter, and gave it to my bosses.

Thank you everyone for your input. I just keep thinking what if I've calculated something incorrectly? Midpack also touched on one of my biggest fears, health insurance ... what if I become very ill and the health insurance plan I have at the time decides to dump me for some preexisting condition or the price skyrockets? It would be so much easier if I could keep the health insurance I have with the government and not have to worry about losing it (even though it's a high deductible plan). If I am offered what will be a very small pension along with health insurance, I won't hesitate to retire.

Brat

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

First make sure that you can participate in the OPM health insurance program. I THINK you need a pension high enough to cover the premium (and I would add, a cushion against increases as HI costs increase faster than your pension). Remember to add the cost of Medicare Part B to the mix when you are 65.

None of us knows how health insurance costs will shake out in the future. I have noticed that the cost of OPM family coverage is higher than Kaiser's Medicare + for two in my community. I was really tempted to ask OPM for a waiver (to be able to return) last open season but thought it best to observe for a year or two.

I retired even earlier than you. You will take a significant age related hit so you need to figure out your survivor benefit %. I made sure that my DH received enough to continue on the HI program.

Work is both an economic and a social activity. Think about how you will spend your time in retirement.

None of us knows how health insurance costs will shake out in the future. I have noticed that the cost of OPM family coverage is higher than Kaiser's Medicare + for two in my community. I was really tempted to ask OPM for a waiver (to be able to return) last open season but thought it best to observe for a year or two.

I retired even earlier than you. You will take a significant age related hit so you need to figure out your survivor benefit %. I made sure that my DH received enough to continue on the HI program.

Work is both an economic and a social activity. Think about how you will spend your time in retirement.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

After income, the biggest fear for most retirees, especially ER's, so you're not alone...... one of my biggest fears, health insurance ... what if I become very ill and the health insurance plan I have at the time decides to dump me for some preexisting condition or the price skyrockets? It would be so much easier if I could keep the health insurance I have with the government and not have to worry about losing it (even though it's a high deductible plan).

Attachments

Last edited:

Hi Vera, welcome to the forum. Lots of us share the health care concern. On the one hand (and without getting political) the PPACA will be reconfirmed - or not - by early next year, and that will clear up our uncertainty, at least as it affects availability of coverage. You can look into your state regulations at the KFF web site here. In most states, if you leave without a health care benefit you are assured coverage for 18 months, and after that period you can convert the policy into individual coverage that cannot be cancelled due to illness. This is not a failsafe option because policies can be cancelled for other reasons, but it is an option you should be aware of and you might want to familiarize yourself with your state regs.Thank you everyone for your input. I just keep thinking what if I've calculated something incorrectly? Midpack also touched on one of my biggest fears, health insurance ... what if I become very ill and the health insurance plan I have at the time decides to dump me for some preexisting condition or the price skyrockets? It would be so much easier if I could keep the health insurance I have with the government and not have to worry about losing it (even though it's a high deductible plan). If I am offered what will be a very small pension along with health insurance, I won't hesitate to retire.

MasterBlaster

Thinks s/he gets paid by the post

- Joined

- Jun 23, 2005

- Messages

- 4,391

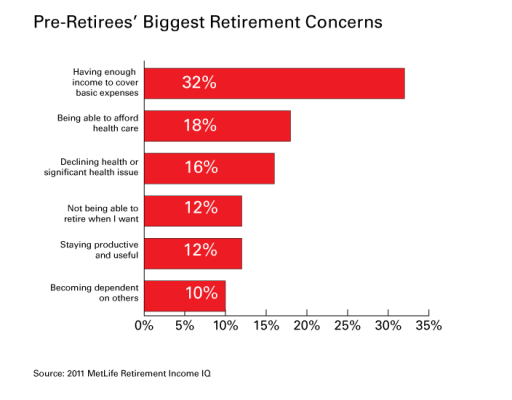

After income, the biggest fear for most retirees, especially ER's, so you're not alone...

A fear of having enough money is the Pre-Retiree great concern.

After retirement settles in, the greatest concern is of your health and mortality.

obgyn65

Thinks s/he gets paid by the post

I have not overcome my fears yet. I am also waiting a few more months to get my 40 quarters to get SS, because I have worked in the US less than 10 years. But it's difficult to make the leap.

Just wondering how others over came their "what if" fears and finally made that leap into retirement?

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,236

I studied my numbers many times over. Make sure you haven't forgotten things like replacing cars, appliances, home maintenance, etc. You don't have to do a worst case budget (your roof isn't going to need to be replaced every 3 years), but you do have to realize that major unexpected expenses will happen over the next 30-40 years, and you should budget a certain amount each year for them. I felt a lot better after my studies of the budget didn't add any increases or new items I had missed or felt I underestimated. You can't be certain of everything, but you can be realistically cautious.

RAE

Thinks s/he gets paid by the post

I don't know the specifics of your financial situation, or why you feel you need to leave your job very soon, but at age 50 and 20 years of service to the Fed. govt., you are not all that far from being able to retire with an annuity and health insurance coverage for life (two very important things to me, when I retired from the feds at age 54 1/2, under an early-out). Early-out offers are becoming more common with a lot of fed. agencies lately, so the odds are actually pretty good that you may get such an offer before your normal retirement date. Another option (though maybe a long shot) is a discontinued service retirement.......have you looked into that possibility? Some coworkers of mine were able to retire at about your age some years ago, on a discontinued service retirement. They are not common, but you would qualify for one (at age 50 with 20 years of service), so it all comes down to whether your agency is willing to work with you on becoming eligible for one or not.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

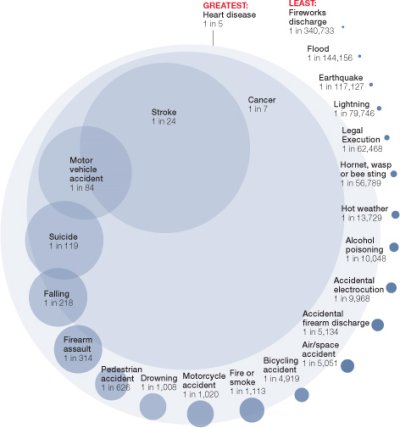

According to the BLS, the odds of dying at work are 1 in 25,000 unless you're a miner (the most hazardous line of work) in which case it's 1 in 4,255. But whatever floats your (statistical) boat...The risk of dieing at my desk scared me more than the risk of early retirement.

Attachments

Last edited:

easysurfer

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 11, 2008

- Messages

- 13,151

I'm hoping for an early out offer next year when I turn 50 and have 20 years of service with the Federal Government but I realize that offer may never come. I have run the numbers and I will be able to retire without it. I may have no other choice but to resign but that scares the *ell out of me. Just wondering how others over came their "what if" fears and finally made that leap into retirement?

Hi Vera. Welcome to the site.

I think that no matter what you do, it's only normal to have some reservations and second thoughts on whether the choice is right or not.

All you can do is do your homework and know then that by doing so, you'd fair okay.

I left when I was 47. Had I stuck it out for 3 more years, I would have qualified for company health benefits (but I hear now that more and more of the costs got shifted to retirees anyhow, so that wasn't so great after all).

I think there is a point of leap of faith, or perhaps a moment of truth. For me, I had did my homework, but the day of telling my boss my plans, I had an inner talk with myself

Looking back, the afternoon, when I walked out of the office for my final time was one of the happiest days of my life.

From the graphic - some of the causes of death might not be mutually exclusive with dying at work.According to the BLS, the odds of dying at work are 1 in 25,000 unless you're a miner (the most hazardous line of work) in which case it's 1 in 4,255. But whatever floats your (statistical) boat...

Suicide (1 in 119) might in fact be a risk at work.

(Only half kidding... I'm really unhappy at my j*b at the moment... Next expected mass layoff is upcoming next week if rumors are true and I'm hoping to win the lottery and get the severance package. Morale here sucks.)

A more cynical perspective on the issue is that in a few years your co-workers or your boss will do something that really annoys the heck out of you.I have run the numbers and I will be able to retire without it. I may have no other choice but to resign but that scares the *ell out of me. Just wondering how others over came their "what if" fears and finally made that leap into retirement?

Suddenly you'll have no problem submitting a resignation...

Similar threads

- Replies

- 43

- Views

- 2K

- Replies

- 51

- Views

- 6K

- Replies

- 159

- Views

- 8K

- Replies

- 15

- Views

- 503

- Replies

- 53

- Views

- 7K