ER.org sounds about right for you.

If your net worth is sub $50K and you are thinking of early retirement, I would say cheap rv living . com (aka living in a van down by the river)

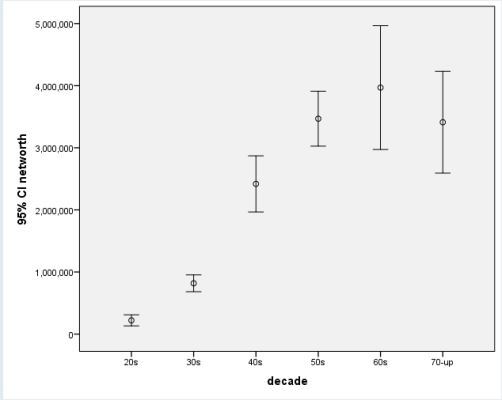

For net worth around $500K, MMM

For net worth around $1M to $5M, ER.org

For net worth of $5M to $30M Bogleheads

For net worth of $30M+, you shouldn't even be wasting time on a financial forum.

I don't know about the cutoffs. Certainly BHs is quite different than here but their fairly exhaustive anonymous survey doesn't have many people with NW above 5M.