I am new to this forum - in fact I'm never written to any forum asking for advise. I am close to retirement and could actually pull the plug today if it became necessary. I am totally invested with the exception of approximately one year's worth of cash which is in a mm fund. I'm roughly 44% Bonds - 56% Equities. Everything in index/passive funds. I'm looking for 35 years. With all of the "talk" about inflation on the rise, why shouldn't I simply put everything into six to eight high quality individual stocks that have paid dividends (4%+) for the past several years. Even if the price of the stock/s should go down from time to time - why should I care as long as the dividends continue to pay?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

What to do?

- Thread starter AZSunset

- Start date

growing_older

Thinks s/he gets paid by the post

- Joined

- Jun 30, 2007

- Messages

- 2,657

How happy would you be if you lost 1/6 of your money (and dividends) if one of your companies went bankrupt. Or twice that if 2 did.

Then there's always the possibility you have an Enron, or some other problem with a company paying above expected market rate dividends. Or inflation outpaces dividend growth. Taking higher risk with concentrated positions can beat the market, but it's also possible to do spectacularly poorly.

Then there's always the possibility you have an Enron, or some other problem with a company paying above expected market rate dividends. Or inflation outpaces dividend growth. Taking higher risk with concentrated positions can beat the market, but it's also possible to do spectacularly poorly.

W2R

Moderator Emeritus

I am no investment wizard, but have a suggestion. I really like VWINX (Vanguard Wellesley Income Fund) and 30% of my portfolio is invested in this fund. It is an actively managed mutual fund but with only a 0.21% expense ratio, and it provides a good amount of dividends while spreading the risk out over many companies.

A fund like this might take a beating in native value during a period of high inflation and rising interest rates, but it would still provide dividends.

A fund like this might take a beating in native value during a period of high inflation and rising interest rates, but it would still provide dividends.

Last edited:

That's a lot of your money on each individual company. Why risk it? Individual companies can hit a huge snag for a number of unpredictable reasons--a big lawsuit, a product liability issues, change in legislation that helped protect their profits, a scandal in the leadership, etc. And, remember (as we recently saw) dividends aren't guaranteed, even good companies will cut them if they need to.

If you're in love with the idea of dividends, then buy a broadly diversified mutual fund that specializes in such stocks--you'll get a lot of diversification for very little in costs. But first research the whole idea of depending on dividends--there's some research that indicates it's just as safe (or safer) to depend on the total return of your portfolio rather than depending solely on dividends.

Welcome to the board.

If you're in love with the idea of dividends, then buy a broadly diversified mutual fund that specializes in such stocks--you'll get a lot of diversification for very little in costs. But first research the whole idea of depending on dividends--there's some research that indicates it's just as safe (or safer) to depend on the total return of your portfolio rather than depending solely on dividends.

Welcome to the board.

Onward

Thinks s/he gets paid by the post

- Joined

- Jul 1, 2009

- Messages

- 1,934

why shouldn't I simply put everything into six to eight high quality individual stocks

High-quality stocks are high quality ... until they're not.

traineeinvestor

Thinks s/he gets paid by the post

While there is plenty of room to debate what amounts to proper diversification, I doubt if you would find too many people who would consider 6-8 stocks a sufficiently diversified portfolio.

Even the "best" of companies can run into trouble without becoming insolvent. To illustrate with just a couple of examples: Pre-crisis, a 6-8 stock portfolio of "quality" stocks would likely have included as least one or two financials - which financials would (again, likely) still be trading lower and paying smaller dividends than before the crisis. Likewise, if BP was regarded by many as a mandatory pick for (UK domiciled) investors looking to dividend income - I suspect it will be a long time before the DPS gets back to its pre-Deep Horizon levels.

Once the paychecks stop arriving, managing risk is more important than maximising returns (IMHO).

Even the "best" of companies can run into trouble without becoming insolvent. To illustrate with just a couple of examples: Pre-crisis, a 6-8 stock portfolio of "quality" stocks would likely have included as least one or two financials - which financials would (again, likely) still be trading lower and paying smaller dividends than before the crisis. Likewise, if BP was regarded by many as a mandatory pick for (UK domiciled) investors looking to dividend income - I suspect it will be a long time before the DPS gets back to its pre-Deep Horizon levels.

Once the paychecks stop arriving, managing risk is more important than maximising returns (IMHO).

I once bought Citigroup at about $52. They had a 4% dividend - around $2/share. Then the stock went down to $2 and my dividend would have been 8 cents/per share, except they cut their dividend payments to 1/10%.

The good news is that the stock is now back up to $40 or so (after a 1 for 10 stock split). Even better news is that I now have a great tax loss that I can harvest and have the IRS share in my 92% loss.

The moral of the story is - be diversified.

The good news is that the stock is now back up to $40 or so (after a 1 for 10 stock split). Even better news is that I now have a great tax loss that I can harvest and have the IRS share in my 92% loss.

The moral of the story is - be diversified.

Point well taken. Thanks for the courtesy of your advice. However I would like to think that if companies such as McDonalds, Coke, Johnson & Johnson, etc., were headed towards bankruptcy it wouldn't come as a sudden surprise - that there would be more than enough "warning" to give one ample time to divest. It just seems that there are so many "experts" suggesting that bonds won't be able to provide enough income - as in times past. These same folks seem to be suggesting that a portfolio of high quality dividend-paying equities is the new road to travel. I dislike risk more than most. However what about the risk of running out of money to fund ones retirement?

brewer12345

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 6, 2003

- Messages

- 18,085

However what about the risk of running out of money to fund ones retirement?

We all run that risk, except for the lucky few with COLAd pensions. You pays your money and you takes your chances. If you cannot "nut up or shut up" on that one, you need to keep working.

traineeinvestor

Thinks s/he gets paid by the post

FWIW, my own investments are allocated largely between real estate and equities with the hope/expectation that rental income and dividends will provide enough income to support us in retirement for 50 + years. We have a relatively limited exposure to bonds - my belief is that, over a long enough time horizon, the real value of equities (and their dividends) will survive better than bonds.

The issue I had with your strategy is not that I disagree with investing in dividend paying stocks (that is part of my own strategy), but that a portfolio of only 6-8 stocks is insufficiently diversified and too risky for my taste - no matter how good the companies are. Personally, I would not be comfortable with anything less than 20 companies (and this in the context of someone who has other assets).

I can also vouch for the fact that recognising when a company is in decline and selling in the early stages of that decline are not as easy in practice as they are in theory.

The issue I had with your strategy is not that I disagree with investing in dividend paying stocks (that is part of my own strategy), but that a portfolio of only 6-8 stocks is insufficiently diversified and too risky for my taste - no matter how good the companies are. Personally, I would not be comfortable with anything less than 20 companies (and this in the context of someone who has other assets).

I can also vouch for the fact that recognising when a company is in decline and selling in the early stages of that decline are not as easy in practice as they are in theory.

Webzter

Full time employment: Posting here.

- Joined

- Jun 29, 2007

- Messages

- 567

In addition to the limited portfolio, I'd be concerned that dividend payouts are increasing as fast as my inflation. That would require stocks that are both good dividend plays and growing (albeit slightly).

I would like to think that if companies such as McDonalds, Coke, Johnson & Johnson, etc., were headed towards bankruptcy it wouldn't come as a sudden surprise - that there would be more than enough "warning" to give one ample time to divest.

What makes you think you would know about that "warning" any earlier than the people you would be selling your stocks to?

Or, to put it another way, if there were "warnings" that those companies were headed toward bankruptcy, why would anyone pay you a good price for your shares in those companies? Why wouldn't they say, "Hold on man, those guys are headed for bankruptcy, why would I pay you full price for them?"

Lots of companies look extremely solid, but turn out to be lemons. There was a time when a list of "rock solid stocks" would have included Enron, Worldcom, GM, Kodak, Polaroid, and Tyco. People who wanted to play it really safe would have stuck with the guaranteed winners, like Bear Stearns, AIG, and Citigroup.

Don't be arrogant - you can't predict the future. Nobody can. You don't know anything everybody else doesn't already know. The market is efficient. Buy the whole market and forget about beating the average.

Ed_The_Gypsy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

We are always getting old news. Even if you spend all your time watching these things, there are much smarter guys with tireless computers and in-depth (read: inside) knowledge of those great companies. Index funds are safer and easier. Pick your asset allocation and stick with it through all markets.

There have been studies that said that 20 individual stocks is all you would need to have the same risk as the entire market. Bernstein refuted that. 20 stocks is too few. If you want to focus, consider Dividend Achievers or Dividend Aristocrats Dividend ETFs: Aristocrats vs. Achievers | ETF Trends

There have been studies that said that 20 individual stocks is all you would need to have the same risk as the entire market. Bernstein refuted that. 20 stocks is too few. If you want to focus, consider Dividend Achievers or Dividend Aristocrats Dividend ETFs: Aristocrats vs. Achievers | ETF Trends

If a person did have the ability to reliably predict when a company was going to have a drop in stock price of 10%, he could make a fortune in a few months in the futures market. It ain't possible. More eggs in the basket is what you want.

To All;

As I stated in my first posting, I am fully invested in passive index funds - all from Vanguard. I have always tended to follow folks such as Rick Ferri who is a strong advocate of passive index fund investing for the long term. I have always managed my own investments. Fifteen years ago I had a negative net worth - now with a lot of luck, prayer and investment discipline I have a portfolio that exceeds the one million dollar mark. This takes into account the "dip" we all went through a few years ago.

I wanted to continue working another five years - just long enough to qualify for Medicare. However it appears that I may have to go on disability (thank goodness for longterm disability insurance). Should that happen my salary will be reduced by some forty percent and I am going to have to purchase health insurance for my me and my wife. If this happens I can make it but not without having to lower expectations for the type of retirement we had planned on enjoying. I was hoping that if I slanted more towards dividend-paying stocks it might help boost our income.

So for all of you who took the time to share your thought I sincerely appreciate it. As a result I'm going to stay where I'm at.

As I stated in my first posting, I am fully invested in passive index funds - all from Vanguard. I have always tended to follow folks such as Rick Ferri who is a strong advocate of passive index fund investing for the long term. I have always managed my own investments. Fifteen years ago I had a negative net worth - now with a lot of luck, prayer and investment discipline I have a portfolio that exceeds the one million dollar mark. This takes into account the "dip" we all went through a few years ago.

I wanted to continue working another five years - just long enough to qualify for Medicare. However it appears that I may have to go on disability (thank goodness for longterm disability insurance). Should that happen my salary will be reduced by some forty percent and I am going to have to purchase health insurance for my me and my wife. If this happens I can make it but not without having to lower expectations for the type of retirement we had planned on enjoying. I was hoping that if I slanted more towards dividend-paying stocks it might help boost our income.

So for all of you who took the time to share your thought I sincerely appreciate it. As a result I'm going to stay where I'm at.

Ed_The_Gypsy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

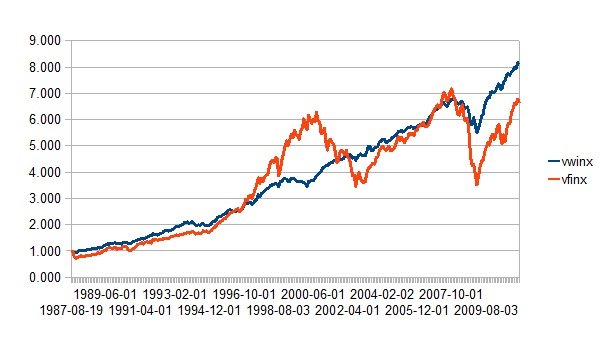

I looked at VWINX vs S&P recently:

http://ca.finance.yahoo.com/q/bc?t=my&s=VWINX&l=on&z=l&q=l&c=&c=^GSPC

Long-term, the S&P did better by a factor of 3x.

Then I checked out various dividend-oriented funds. VIG stood out (even though it is young).

http://ca.finance.yahoo.com/q/bc?t=my&s=VIG&l=on&z=l&q=l&c=&c=^GSPC

Oddly enough, the other dividend funds (SPY etc) did not look as good over the long term also.

http://ca.finance.yahoo.com/q/bc?t=my&s=SDY&l=on&z=l&q=l&c=vwinx&c=^GSPC

VWINX is smoother than the S&P. If you like sleeping soundly, it would be fine.

http://ca.finance.yahoo.com/q/bc?t=my&s=VWINX&l=on&z=l&q=l&c=&c=^GSPC

Long-term, the S&P did better by a factor of 3x.

Then I checked out various dividend-oriented funds. VIG stood out (even though it is young).

http://ca.finance.yahoo.com/q/bc?t=my&s=VIG&l=on&z=l&q=l&c=&c=^GSPC

Oddly enough, the other dividend funds (SPY etc) did not look as good over the long term also.

http://ca.finance.yahoo.com/q/bc?t=my&s=SDY&l=on&z=l&q=l&c=vwinx&c=^GSPC

VWINX is smoother than the S&P. If you like sleeping soundly, it would be fine.

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I looked at VWINX vs S&P recently:

http://ca.finance.yahoo.com/q/bc?t=my&s=VWINX&l=on&z=l&q=l&c=&c=^GSPC

Long-term, the S&P did better by a factor of 3x.

Careful, those charts are for NAV, they don't include dividends, and VWINX pays higher divs than SPY - it adds up.

Go to vanguard and do a compare on 'growth of $10,000'. Only goes back 10 years though. Or pull the 'adjusted prices' from yahoo historical prices and do your own plot.

-ERD50

freebird5825

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

For a dividend paying mutual fund that follows an index (specifically set up for VG) ...check out VHDYX. It's very new (< 5 years if memory serves), so long term performance data is not in yet.

Welcome to the forum

Welcome to the forum

Ed_The_Gypsy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I stand corrected. VWINX is much cooler!Careful, those charts are for NAV, they don't include dividends, and VWINX pays higher divs than SPY - it adds up.

Go to vanguard and do a compare on 'growth of $10,000'. Only goes back 10 years though. Or pull the 'adjusted prices' from yahoo historical prices and do your own plot.

-ERD50

Attachments

REWahoo

Give me a museum and I'll fill it. (Picasso) Give

FreeAtLast

Full time employment: Posting here.

- Joined

- Apr 22, 2008

- Messages

- 702

High quality stocks don't always stay high quality. Things change. Many things have to go right for a company to be successful year after year.