Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

"Buying the annuity locks the $$ in a certain value versus an unknown value" is true. But buying now provides the lowest possible income per year vs upfront annuity cost and forgoes the real returns from that sum forever. Lump sums are larger than normal today for the same reason. Real returns could be average or even above in the long run, I'm nt ready to just give that return away just yet.^^^^ This makes alot of sense except for one point I will play the devil's advocate on .... "You can buy an annuity with your lump sum tomorrow, wait until you're 75" The reverse of that statement is what the basis of an annuity is predicated on -- Depending on what you screwup or the market does to you between now and "75" determines whether you will or will not have that $$ to get an annuity later --- Buying the annuity locks the $$ in a certain value versus an unknown value.

We've debated this several times.

First, as I mentioned in #21 above, the upfront cost of annuities are at or near all time highs. IOW they've (almost) never been more expensive for a given annual income. If you can wait (and I realize not everyone can for a variety of reasons), you could buy the same income for less when interest rates rise (and they will but who knows when). If we were in an average interest rate environment, the cost of an annuity could go up or down and the benefit to waiting would be uncertain. That's just not the case at present.

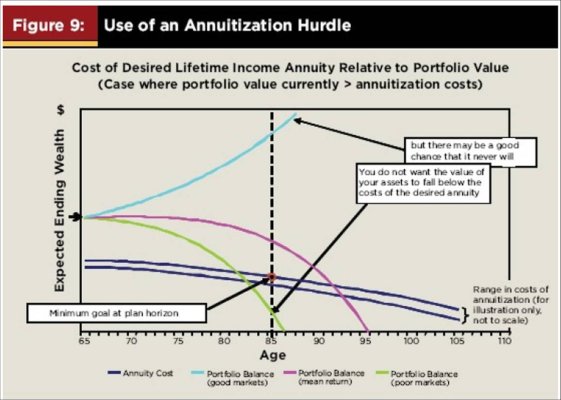

If your portfolio is at a surplus vs the cost of annuity, and real returns are average or better, if you buy an annuity now you forever forego those returns on that money. That could literally be $ millions. I am not suggesting anyone arbitrarily wait until 75 to buy an annuity. I advocate constantly comparing your portfolio to the cost of an annuity that provides the income needed to cover base expenses (at a minimum), I get an annuity quote quarterly. If I get close to my "annuitization hurdle", I will annuitize at least some of my portfolio then, whether I am 60, 80 or anywhere in between. As long as I don't wait too long there isn't much downside that I see. I've posted articles explaining the approach so many times I'm afraid to link to it again, but you can search.

I realize some people just prefer to buy an annuity to avoid the uncertainty in waiting - there's nothing wrong with that. As long as buyers understand what they may be giving up, it could be $ millions for many here, I don't care what anyone else does. It seems worthwhile to me to explain the options, especially in this interest rate environment. Anyone who says there's one right answer, doesn't know what they're talking about...

Last edited: