You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

10 year treasuries 1.097 %

- Thread starter Breedlove

- Start date

Big_Hitter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

do you mean 1.97%?

saw that when i was working out this morning

saw that when i was working out this morning

corn18

Thinks s/he gets paid by the post

- Joined

- Aug 30, 2015

- Messages

- 1,890

Just emailed my mortgage broker and asked him to see if he can find me a 15 year, no points, with an interest rate <3%. I'm at 3.875% so not sure if it would be worth the closing costs that TX charges.

Breedlove

Thinks s/he gets paid by the post

it I can't believe it . I am hearing money is coming into the U S faster then we can loan it out . It might mean we are going to strike Iran soon Or Or these money countries are not so secure right now .

- Joined

- Nov 17, 2015

- Messages

- 13,949

It's probably more likely due to the Fed signaling that interest rates may take a haircut later this year.

copyright1997reloaded

Thinks s/he gets paid by the post

Might have something to do with:

1) Fed signalling lower rates

2) A US military drone being shot out of the sky

3) Below zero rates in many European countries

Finally my GLD and gold coins are starting to look better.

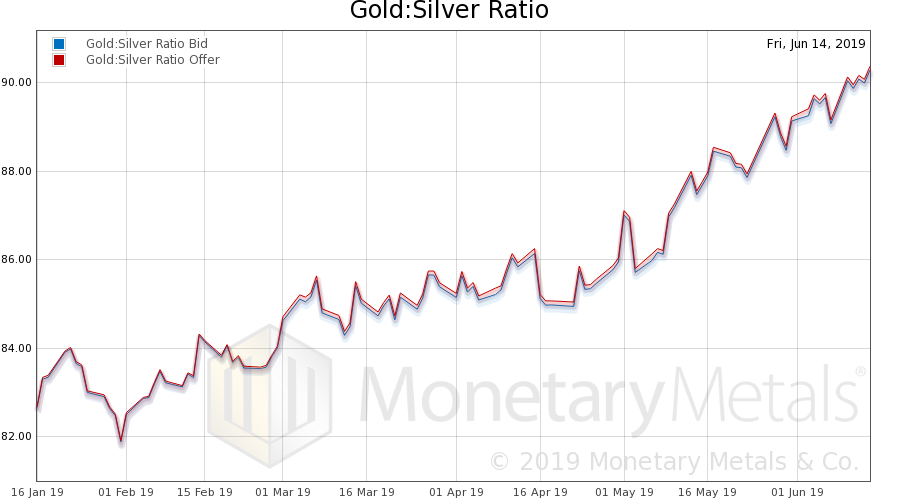

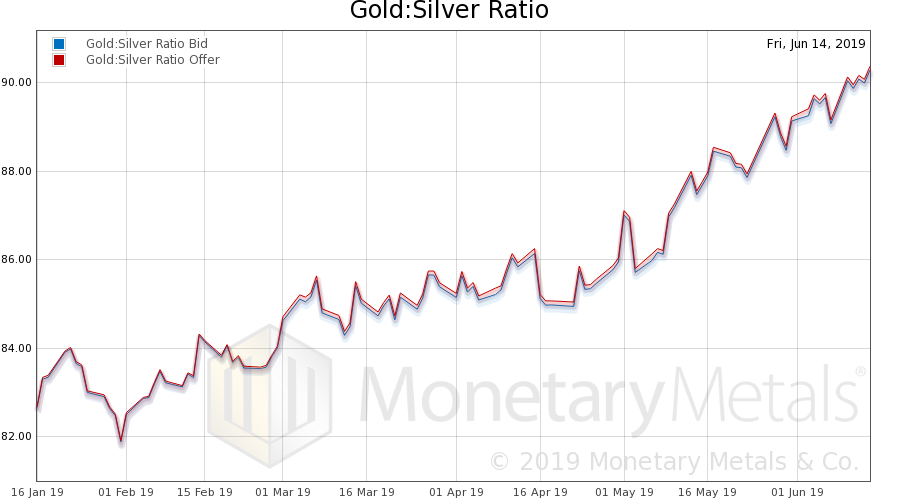

Here's an interesting chart, showing the Gold/Silver ratio:

So far in 2019 Gold is leaving Silver behind. This makes Silver a catch up trade candidate OR something else is going on, e.g. Silver has industrial demand which is waning or perhaps Gold is more of a 'crisis' metal (held by central banks). Dunno, but it is interesting.

1) Fed signalling lower rates

2) A US military drone being shot out of the sky

3) Below zero rates in many European countries

Finally my GLD and gold coins are starting to look better.

Here's an interesting chart, showing the Gold/Silver ratio:

So far in 2019 Gold is leaving Silver behind. This makes Silver a catch up trade candidate OR something else is going on, e.g. Silver has industrial demand which is waning or perhaps Gold is more of a 'crisis' metal (held by central banks). Dunno, but it is interesting.

ncbill

Thinks s/he gets paid by the post

I'm selling everything I can today before we go to war with Iran.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I'm selling everything I can today before we go to war with Iran.

You are supposed to buy when the cannons are booming.

You are supposed to buy when the cannons are booming.

right now its still the sabres rattling

foxfirev5

Thinks s/he gets paid by the post

- Joined

- Mar 22, 2009

- Messages

- 2,987

Just emailed my mortgage broker and asked him to see if he can find me a 15 year, no points, with an interest rate <3%. I'm at 3.875% so not sure if it would be worth the closing costs that TX charges.

Maybe not now but perhaps soon. For the last year I've had a much greater fear of lower not higher interest rates. I've done everything I could to lock in those 3+ % CD's. Now that has passed. Perhaps my next move will be to borrow some (I didn't see that coming) if the real estate bubble pops again.

Last edited:

Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

It's probably more likely due to the Fed signaling that interest rates may take a haircut later this year.

Information received since the Federal Open Market Committee

met in May indicates that the labor market remains

strong and that economic activity is rising at a

moderate rate. Job gains have been solid, on average, in

recent months, and the unemployment rate has remained low.

Although growth of household spending and appears to

have picked up from earlier in the year, indicators of business

fixed investment slowed in the first quarter.have been soft. On

a 12-month basis, overall inflation and inflation for items other

than food and energy have declined and are running below 2

percent. On balance, Market-based measures of

inflation compensation have remained low in recent months,

; survey-based measures of longer-term inflation

expectations are little changed.

Consistent with its statutory mandate, the Committee seeks to

foster maximum employment and price stability. In support of

these goals, the Committee decided to maintain the target

range for the federal funds rate at 2-1/4 to 2-1/2 percent. The

Committee continues to view sustained expansion of economic

activity, strong labor market conditions, and inflation near the

Committee's symmetric 2 percent objective as the most likely

outcomes., but uncertainties about this outlook have increased.

In light of global economic and financial

uncertainties and muted inflation pressures, the Committee will

be patient as it determines what future adjustments

monitor the target implications of incoming information for

the federal funds rate may be economic outlook and will act as

appropriate to support the expansion,

with a strong labor market and inflation near its symmetric 2

percent objective.

In determining the timing and size of future adjustments to the

target range for the federal funds rate, the Committee will

assess realized and expected economic conditions relative to

its maximum employment objective and its symmetric 2 percent

inflation objective. This assessment will take into account a

wide range of information, including measures of labor market

conditions, indicators of inflation pressures and inflation

expectations, and readings on financial and international

developments.

Yes I saw where the "The Committee will be patient" has been adjudicated to mean cutting in July no matter what! All of that based on the gobbledygook the Fed puts out in an effort for "transparency".

Information received since the Federal Open Market Committee

met in May indicates that the labor market remains

strong and that economic activity is rising at a

moderate rate. Job gains have been solid, on average, in

recent months, and the unemployment rate has remained low.

Although growth of household spending and appears to

have picked up from earlier in the year, indicators of business

fixed investment slowed in the first quarter.have been soft. On

a 12-month basis, overall inflation and inflation for items other

than food and energy have declined and are running below 2

percent. On balance, Market-based measures of

inflation compensation have remained low in recent months,

; survey-based measures of longer-term inflation

expectations are little changed.

Consistent with its statutory mandate, the Committee seeks to

foster maximum employment and price stability. In support of

these goals, the Committee decided to maintain the target

range for the federal funds rate at 2-1/4 to 2-1/2 percent. The

Committee continues to view sustained expansion of economic

activity, strong labor market conditions, and inflation near the

Committee's symmetric 2 percent objective as the most likely

outcomes., but uncertainties about this outlook have increased.

In light of global economic and financial

uncertainties and muted inflation pressures, the Committee will

be patient as it determines what future adjustments

monitor the target implications of incoming information for

the federal funds rate may be economic outlook and will act as

appropriate to support the expansion,

with a strong labor market and inflation near its symmetric 2

percent objective.

In determining the timing and size of future adjustments to the

target range for the federal funds rate, the Committee will

assess realized and expected economic conditions relative to

its maximum employment objective and its symmetric 2 percent

inflation objective. This assessment will take into account a

wide range of information, including measures of labor market

conditions, indicators of inflation pressures and inflation

expectations, and readings on financial and international

developments.

Yes I saw where the "The Committee will be patient" has been adjudicated to mean cutting in July no matter what! All of that based on the gobbledygook the Fed puts out in an effort for "transparency".

Exactly. Reading the above I do not get the "Fed is dovish" headlines that are plastered everywhere today.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I think if money had been flooding into the right now US we would see the dollar strengthening. Instead dollar has been weakening a bit with respect to the Euro. It was stronger a month ago.

I think this is sudden anticipation of a Fed rate cut - which tends to weaken the dollar.

I think this is sudden anticipation of a Fed rate cut - which tends to weaken the dollar.

You are supposed to buy when the cannons are booming.

I'm buying cannons.

right now its still the sabres rattling

I'm buying sabres.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I'm buying cannons.

BOOM!

Another Reader

Thinks s/he gets paid by the post

- Joined

- Jan 6, 2013

- Messages

- 3,413

I'm buying margaritas in Mexico the week after next.

And that's exactly the right attitude!

RAE

Thinks s/he gets paid by the post

I think this is sudden anticipation of a Fed rate cut - which tends to weaken the dollar.

+1

Was it in the Dominican Republic? Did ya all survive?I went to a Margarita festival last month. Does that count?

Another Reader

Thinks s/he gets paid by the post

- Joined

- Jan 6, 2013

- Messages

- 3,413

I'm waiting for mortgage rates to drop to the 2012 lows again... Oddly, there does not to be as much correlation to the 10 year treasury as there usually is. Rates haven't moved much at all in the last couple of days.

Similar threads

- Replies

- 23

- Views

- 1K

- Replies

- 20

- Views

- 1K

- Replies

- 12

- Views

- 882