TromboneAl

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 30, 2006

- Messages

- 12,880

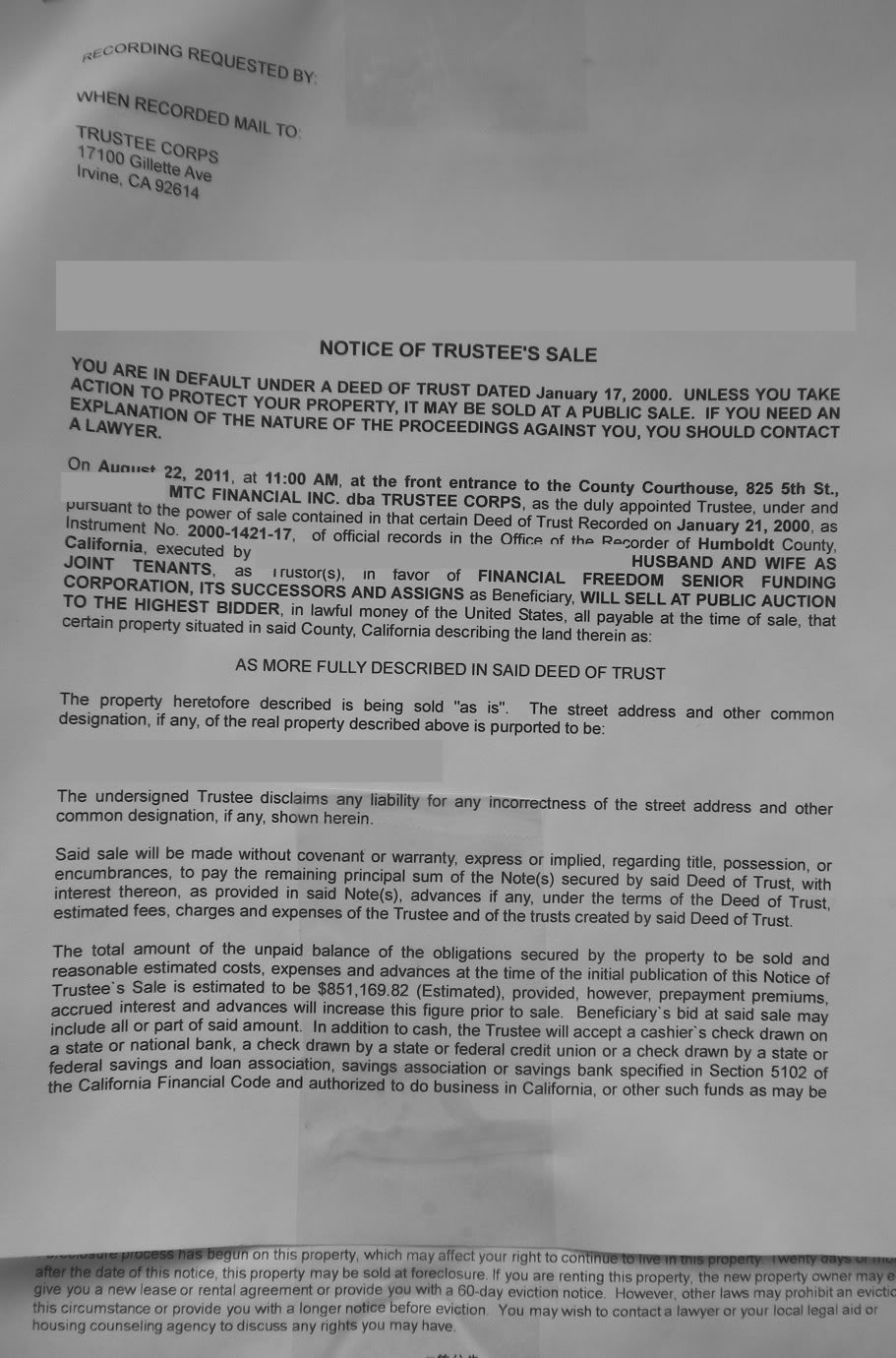

The notice below appeared on the neighbor's abandoned house a few days ago. It says the house is going to be auctioned off, and the total unpaid balance and expected expenses totals $851,000. It says "Beneficiary's bid may include part or all of said amount."

Does that last part mean that much lower bids will not be accepted??

Any other thoughts on what will happen with this house, and how long it would take? Our worry, of course, is that some dope grower will buy it at a low price.

Does that last part mean that much lower bids will not be accepted??

Any other thoughts on what will happen with this house, and how long it would take? Our worry, of course, is that some dope grower will buy it at a low price.