ExFlyBoy5

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

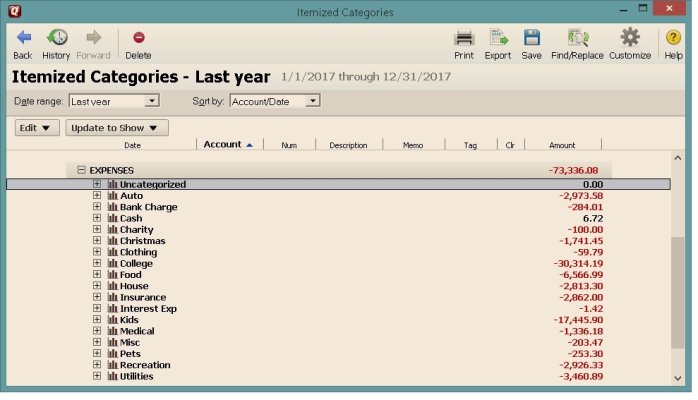

Costs for two adults and 4 furry critters...

Category|Total for 2017|Comments

Groceries|$7438.00|Includes toiletries, detergent, etc.

Restaurants|$2512.00|

Transportation|$2542.00|Maintenance, gas, registration.

Insurance|$2560.00|Home, auto, umbrella.

House|$3700.00|Taxes and maintenance.

Utilities|$4346.00|Internet, nat. gas, electricity, water, trash, cell, alarm.

Clothes|$120.00|Retirement uniforms are still in good shape!

Travel|$1210.00|

Cash|$500.00|Haircuts, etc.

Medical|$1800.00|Have Tricare, hence the low cost.

Pets|$4783.00|Majority was for older dog that is no longer with us.

Miscellaneous|$4788.00|New bed/mattress and other unclassified expenses.

Total|$36299.00| plus income tax

We saved a good chuck of change on travel through the Chase Sapphire Reserve card....in the neighborhood of $2600.00

"Above and Beyond" expenses this year was a new bed and mattress ($3000) and gutter replacement on the house ($1500).

Groceries|$7438.00|Includes toiletries, detergent, etc.

Restaurants|$2512.00|

Transportation|$2542.00|Maintenance, gas, registration.

Insurance|$2560.00|Home, auto, umbrella.

House|$3700.00|Taxes and maintenance.

Utilities|$4346.00|Internet, nat. gas, electricity, water, trash, cell, alarm.

Clothes|$120.00|Retirement uniforms are still in good shape!

Travel|$1210.00|

Cash|$500.00|Haircuts, etc.

Medical|$1800.00|Have Tricare, hence the low cost.

Pets|$4783.00|Majority was for older dog that is no longer with us.

Miscellaneous|$4788.00|New bed/mattress and other unclassified expenses.

Total|$36299.00| plus income tax

We saved a good chuck of change on travel through the Chase Sapphire Reserve card....in the neighborhood of $2600.00

"Above and Beyond" expenses this year was a new bed and mattress ($3000) and gutter replacement on the house ($1500).

Last edited:

Though if at 16 and 18 the schooling costs are just the tip of the iceberg.

Though if at 16 and 18 the schooling costs are just the tip of the iceberg.