audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

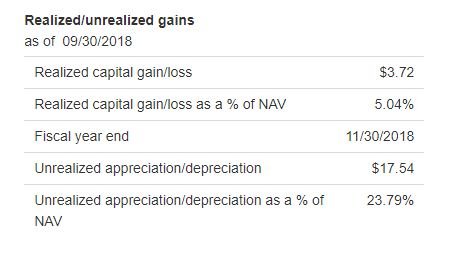

A few mutual funds have already published their year end 2018 estimated capital gains distributions. But I haven’t seen anything from Fidelity or Vanguard yet.

Last year it looks like I had the estimates by Oct 29, as that’s a date of a saved spreadsheet. I just don’t remember when they are usually published in October.

Last year it looks like I had the estimates by Oct 29, as that’s a date of a saved spreadsheet. I just don’t remember when they are usually published in October.