Here's a story about a guy, let's call him Frank. He's in his 50s and has been retired for a few years. We don't really know what he's like, because that really doesn't matter when it comes to money, does it? But rest assured he knows the value of a dollar and knows to do an accurate budget, even accounting for home and car repairs he may not be able to handle himself. He's run Firecalc and other tools to verify he's got enough funds to cover himself for many, many years of retirement in just about any economic climate we've ever seen.

Frank wishes he knew how to pick individual stocks or know when to get in or out of the market, but has realized he's not that smart or lucky, so he mostly holds total market index funds, in both international and US stocks and bonds, according to his pre-determined asset allocation. He's very satisfied that he's diversified over not just a large number of holdings in those funds, but they also cover every sector of the market.

Frank cares very, very much about the size of his portfolio, because when it comes down to it, he's going to be spending money so he better always have money to spend. He may run into unforeseen expenses that put a dent in his account, so he'd like to keep the balance as high as possible, while of course, minimizing the risk. Hence, his reliance on index funds and a reasonable AA.

The yield on his investments throws somewhere around 2% a year, which is a bit over half of what he needs. So he has to sell some of his funds to come up with the rest, less so when he becomes eligible for social security and a small pension. But that's ok, he realizes that long term capital gains are every bit as tax advantaged as qualified dividends, plus the basis on his sales are not taxed, just the gains, so he actually pays less in taxes than if his yield was higher. In fact, if he has reason to want to limit income, perhaps to qualify for an ACA subsidy or leave more room to partially convert his tIRA to a Roth IRA, he can do so by selling the shares with the highest basis. Some of them might even be at a loss, which he never hoped for, but might as well take advantage of.

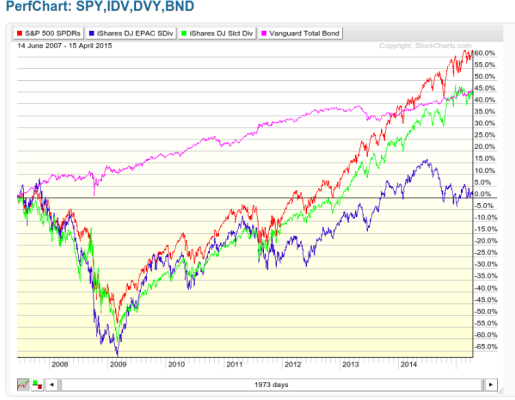

Of course selling those shares reduces his nest egg, but it's ok because his portfolio had a very nice run-up over the last couple of years, so he's still well ahead of where he would've been had he invested in high dividend, slow growth funds. When the market dipped a few years ago, instead of selling stocks at a low price, he sold some of his bond holdings to rebalance his portfolio. His buying days are over so there's no longer a chance to "buy low", but he's got the "sell high" part down pretty well.

Certainly it would be nice to not have to sell any funds at all, but he realizes that if the market goes through a prolonged downturn, any strategy (other than correctly timing events) is likely to have problems. The best thing he can do is to safely build up his funds when the market is good, and hold the course while weathering the downturns.

Nice story, isn't it?