gcgang

Thinks s/he gets paid by the post

- Joined

- Sep 16, 2012

- Messages

- 1,571

https://www.americanfunds.com/pdf/mfcpwp-028_capidea913.pdf

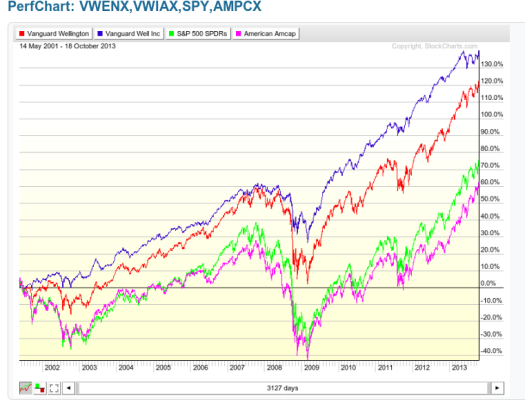

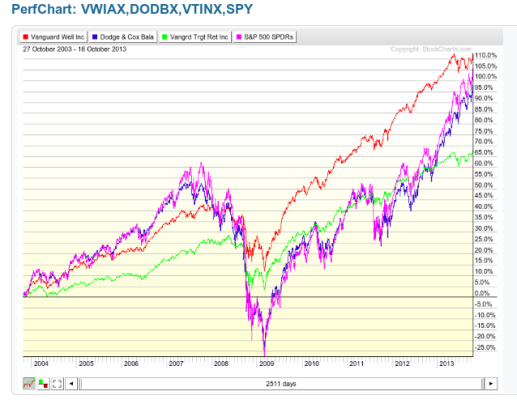

While I know this will brand me a heretic on this board, above link seems to make a compelling case for some (one in particular) active managers.

The idea of suffering less when the index goes down is particularly appealing.

Full disclosure - I've had $ with this organization for 30 years. I did not have to pay the sales charge as shares were purchased thru a company plan. Now I've retired, I have enough with them that additional purchases are not subject to the charge due to the "ROA breakpoint".

While I would incur no tax hit to change investments in my IRRA, it doesn't seem to make sense to change to indexes, assuming the funds still meet my objectives. Right?

While I know this will brand me a heretic on this board, above link seems to make a compelling case for some (one in particular) active managers.

The idea of suffering less when the index goes down is particularly appealing.

Full disclosure - I've had $ with this organization for 30 years. I did not have to pay the sales charge as shares were purchased thru a company plan. Now I've retired, I have enough with them that additional purchases are not subject to the charge due to the "ROA breakpoint".

While I would incur no tax hit to change investments in my IRRA, it doesn't seem to make sense to change to indexes, assuming the funds still meet my objectives. Right?