WestLake

Recycles dryer sheets

- Joined

- Jun 7, 2011

- Messages

- 239

http://bloomberg.com/news/2012-06-03/aig-chief-sees-retirement-age-as-high-as-80-after-crisis.htm

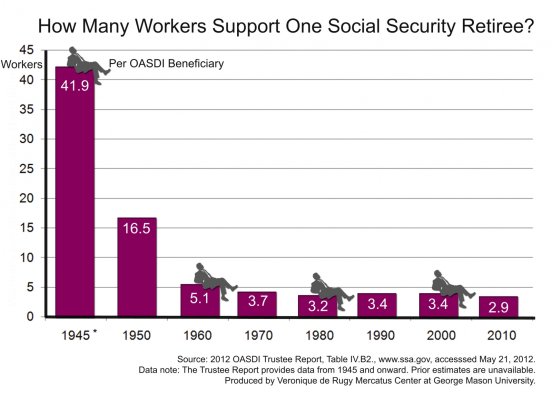

l“Retirement ages will have to move to 70, 80 years old,” Benmosche, who turned 68 last week, said during a weekend interview at his seaside villa in Dubrovnik, Croatia. “That would make pensions, medical services more affordable. They will keep people working longer and will take that burden off of the youth.”

l“Retirement ages will have to move to 70, 80 years old,” Benmosche, who turned 68 last week, said during a weekend interview at his seaside villa in Dubrovnik, Croatia. “That would make pensions, medical services more affordable. They will keep people working longer and will take that burden off of the youth.”