Now that Ally Bank is paying us off for our recent large saving bonuses, Capital One 360 is offering a similar great deal with up to a $500. bonus.

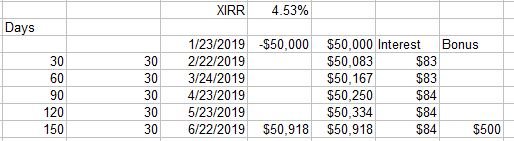

Open a Money Market account with between $10,000. and $49,999. and get a $200. cash bonus, $50,000. and more gets a $500. bonus. Unfortunately for me I already have an account with Capital One and don't qualify. I took advantage of this same deal a couple of years ago. Technically you can take $50,000. from that new Ally account now and get $500. more.

https://www.capitalone.com/celebrate200/

Open a Money Market account with between $10,000. and $49,999. and get a $200. cash bonus, $50,000. and more gets a $500. bonus. Unfortunately for me I already have an account with Capital One and don't qualify. I took advantage of this same deal a couple of years ago. Technically you can take $50,000. from that new Ally account now and get $500. more.

https://www.capitalone.com/celebrate200/