We are now retired for quite some time and doing fine financially. CD rates are at about 5% and I moved a considerable portion of our portfolio into CD’s. I use various online banks (Synchrony, Ally, Discover to name a few).

Since Firecalc has us at 100% with this form of investing we’re taking advantage for the next year or so of this.

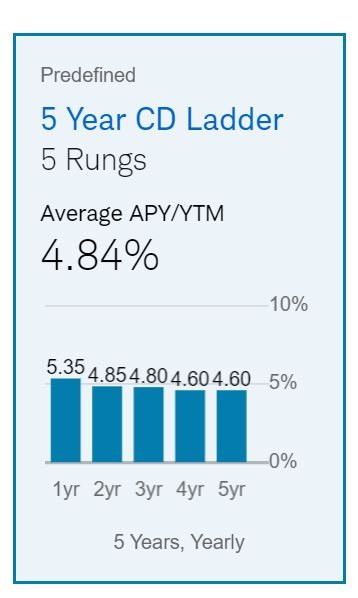

Some are offering a 4.5 or so for longer term. My question is what should be the longest I lock my money into CDs and at what rate should be my minimum?

Also, we have a TIRA brokered CD maturing at Vanguard in December. They’ll put the money in their MM for now, but am at a loss as to what to do long term for this amount ($100,000). We’re looking for preservation more than huge gains.

Thank you

Since Firecalc has us at 100% with this form of investing we’re taking advantage for the next year or so of this.

Some are offering a 4.5 or so for longer term. My question is what should be the longest I lock my money into CDs and at what rate should be my minimum?

Also, we have a TIRA brokered CD maturing at Vanguard in December. They’ll put the money in their MM for now, but am at a loss as to what to do long term for this amount ($100,000). We’re looking for preservation more than huge gains.

Thank you