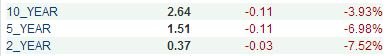

Common wisdom was saying this for months prior to May, the big jump has happened in the last 2 months. Looks like they were right.

Much wisdom in many posts, including those upthread.

1) Verem is right, I suspect (but don't know). The market recently may have overreacted, so if you are reacting to it now with big moves, you probably are mistiming. Or may be. But it is a wakeup call.

2) I was afraid of this for two years, so have gradually reduced duration and moved from intermediates to shortterm, cash, floating rate and similar. If I had the room in my taxables or wife's roll over IRA, I'd move a bond slice to Guggenheim bullet bonds, but that doesn't seem optimal; I'd rather place this in dividend stocks and closed-ends. I'm probably wrong on this active activity.

3) For those with a 20 year perspective, just rebalancing is the best idea. Those of you who said "do nothing" are right, from this perspective.

Barring that, rebalancing with a barbell strategy might be worth considering--realizing that the long term of the barbell may crush you if interest rates rise as you are opining. I reduced duration to move bonds more towards cash, with Emerging Market and High Income as the "barbell." I'll probably be proved wrong.

And barring that, moving some of the bond% DCA slowwwwly to floating rate and short term might make you feel better. That's what I did the last 2 years. Bonds still got crushed so that the portfolio is performing about 40% of the S&P but it could have been a lot worse without the moves above. That's after only two months of rate increases and YTD, so I don't think that's a good test of any strategy.

4) If you can tolerate the volatility--if--shifting some of your cash into dividend, particularly Euro or foreign dividend might be worth considering, DCA in particular. I'm doing a bit of that.

5) And I continue to consider my cash holdings as a percentage of my bond holdings.

This does not hold water on Allocations, but it is because I think we are 5 years or less from the bond peak, if we haven't seen it already. Cash is not trash, and will give you flexibility for balancing, either to underpriced bonds or stocks.

6) If you are in the position of building a bond ladder and reallocating bond mutual bunds to do so, consider doing so, although you do take on default risk. This is not a trivial risk, although the more you have to diversify in individual bonds, the safer you are.

If I were in the position to do so, I would do so, with 1/2 of my bond allocation and the point on cash above (#5) would be moot. A lot of my cash is in IRA/401ks in which I cannot buy individual bonds and using my taxable account funds for a bond ladder--I believe--is unwise.

This is a very good thread, and all posts should be considered before anyone does anything.

And my sense is that the market has already done most of its moves, shortterm, so this is kind of test case for what the next 5 years might hold, so it is very useful. I could be wrong here, and the selling could accelerate, but I think it has been a short-term overreaction to taper, although the long-term direction is clear. IMO, which is worth nothing to any of you.

) up, the highest probability in making the most amount of money was in selling bonds and intermediate and long term bond funds when mortgage rates hit an all time, historic low and rebuying at some point later on.

) up, the highest probability in making the most amount of money was in selling bonds and intermediate and long term bond funds when mortgage rates hit an all time, historic low and rebuying at some point later on.