moneymaker

Recycles dryer sheets

- Joined

- Mar 13, 2013

- Messages

- 106

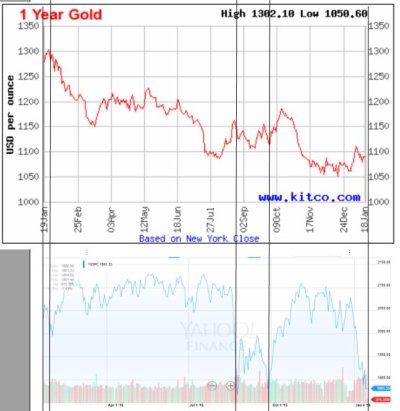

If anyone lives by the motto of buying when everyone is scared, isn't now a good time to buy Gold or Gold miners (GDX/GDXJ)?

It's been slaughtered since 2011. Eventually, there can be A LOT of money made here. I can see folks that are already retired not wanting to wait, but what about for the folks that have 10+ years to retire.

Thoughts?

It's been slaughtered since 2011. Eventually, there can be A LOT of money made here. I can see folks that are already retired not wanting to wait, but what about for the folks that have 10+ years to retire.

Thoughts?