Another Reader

Thinks s/he gets paid by the post

- Joined

- Jan 6, 2013

- Messages

- 3,413

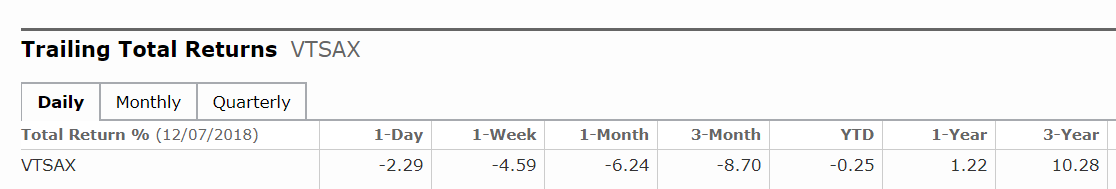

Thinking the RMD from my inherited IRA may actually decline next year if the stock market rout continues, despite subtracting a year from the divisor. I have been taking more than the RMD to smooth out the tax hit, trying to reduce it when my own IRAs come on line.

With a big drop in value, I will probably cut the withdrawals back to the RMD. A lot of the withdrawn money went to pay off the rental real estate debt so it won't mean dining on Friskies by candlelight under the overpass here, but I will bet there will be some belts tightened out there if this scenario comes to pass.

Anyone else looking at reducing withdrawals next year if the rout continues? Even if you do not reduce your withdrawals, will you reduce your spending?

With a big drop in value, I will probably cut the withdrawals back to the RMD. A lot of the withdrawn money went to pay off the rental real estate debt so it won't mean dining on Friskies by candlelight under the overpass here, but I will bet there will be some belts tightened out there if this scenario comes to pass.

Anyone else looking at reducing withdrawals next year if the rout continues? Even if you do not reduce your withdrawals, will you reduce your spending?