Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

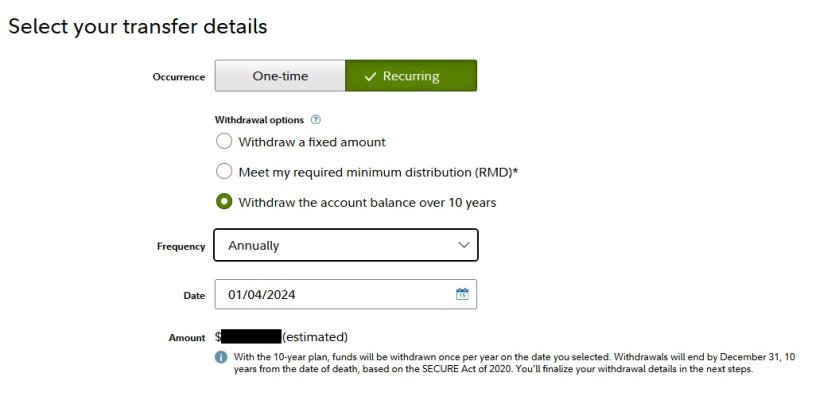

Different RMD question.

Theoretically if the life expectancy tables aren't changed, then for those who start RMD's at 75 y.o., would for example the required percentage takeout for age 76 be the same percentage as required for age 76 currently?

Theoretically if the life expectancy tables aren't changed, then for those who start RMD's at 75 y.o., would for example the required percentage takeout for age 76 be the same percentage as required for age 76 currently?