Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

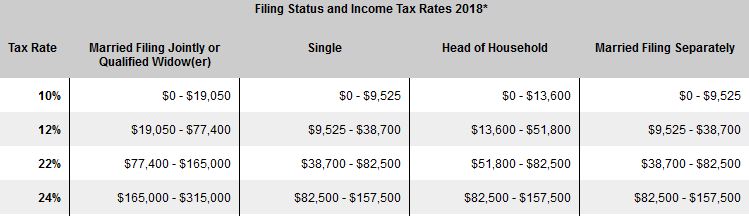

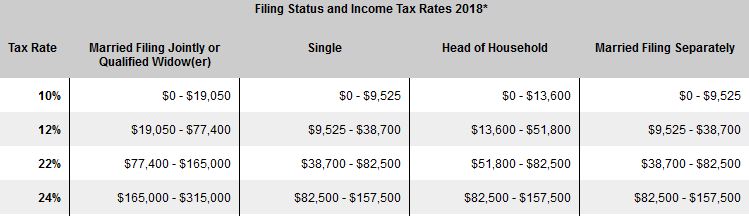

After taking out my RMD's for the year (1st year for me) and figuring in Social Security I find that there is still more I can take out at low rates for couples. See the rate chart below and link to a nice tax calculator for 2018. I find that we can take out a lot more at marginal Federal tax rates of roughly 14% (which is higher then 12% until SS is 85% taxed) until our total taxable income hits $77.4 K. That seems like perhaps a historical opportunity.

I wonder how many others are taking out more then their required IRA distributions because of the current low tax rates? It's not fun to pay more taxes but who knows if these low rates will continue for many years.

-----------------

Nice 2018 tax calculator I used: https://www.mortgagecalculator.org/calcs/1040-calculator.php

I wonder how many others are taking out more then their required IRA distributions because of the current low tax rates? It's not fun to pay more taxes but who knows if these low rates will continue for many years.

-----------------

Nice 2018 tax calculator I used: https://www.mortgagecalculator.org/calcs/1040-calculator.php