i thought bill bernsteins switch in sentiment about retirees not owning equities was kind of strange too.

in his e-book the ages of the investor bill shuns all equities for tips,annuities and short term bonds . if you have any extera dough after meeting your income needs you can through it in a risk portfolio.

We've had this discussion here before, and what Dr Bernstein said.

WB: "His latest obsession, resulting in the short e-book "The Ages of the Investor," ...

This seems to be what alarmed a lot of retirees:

WB: "How risky stocks are to a given investor depends upon which part of the life cycle he or she is in. For a younger investor, stocks aren't as risky as they seem. For the middle-aged, they're pretty risky. And for a retired person, they can be nuclear-level toxic."

Of course stocks can be nuclear level toxic for retirees, otherwise you'd have FAs advocating high equity asset allocations. When has that ever been true? Never in my lifetime...

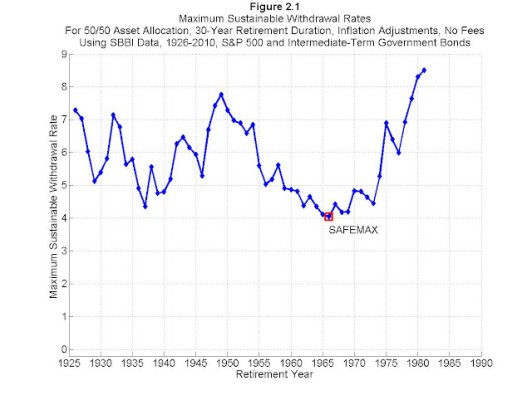

Instead of advocating some seemingly arbitrary asset allocation, the fashion now seems to be have enough safe assets to ensure your basic needs are met, and then take some risk with the excess if you like. And the latter does make more sense than some arbitrary AA such as '100-age' in equities. If you have no excess you can't afford any risk, if you have double the nest egg needed when you retire, you could put as much as half your portfolio in equities. Using '100-age' in both these cases makes no sense whatsoever.

WB goes on to say:

WB: "You want to end up with a portfolio that matches your liabilities, meaning the amount you'll need to spend in retirement. The rule of thumb I came up with, based on annuity payouts and spending patterns late in life, is that you should save 20 to 25 times your residual living expenses -- that is, the yearly shortfall you have to make up after Social Security and any pension.

This portfolio should be in safe assets: Treasury Inflation-Protected Securities, annuities, or even short-term bonds.

Anything above that, you can invest in risky assets. That's your risk portfolio. If you dream about taking an around-the-world trip, and the risk portfolio does well, you can use it for that. If the risk portfolio doesn't do well, at least you're not pushing a shopping cart under an overpass."

Dr Bernstein seems to be gravitating toward the floor income concept, not a new idea by any means, the same concept that Wade Pfau, Jim Otar and others have been advocating for some time.

"Shun[ning] all equities for tips,annuities and short term bonds" would only be the case if your portfolio was already in Otar's red zone, IOW if you only have enough to meet your essential expenses, you can't afford to take any (equity) risk. Again, not a new concept...

The worst retirement investing mistake - Sep. 4, 2012