mathjak107

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 27, 2005

- Messages

- 6,208

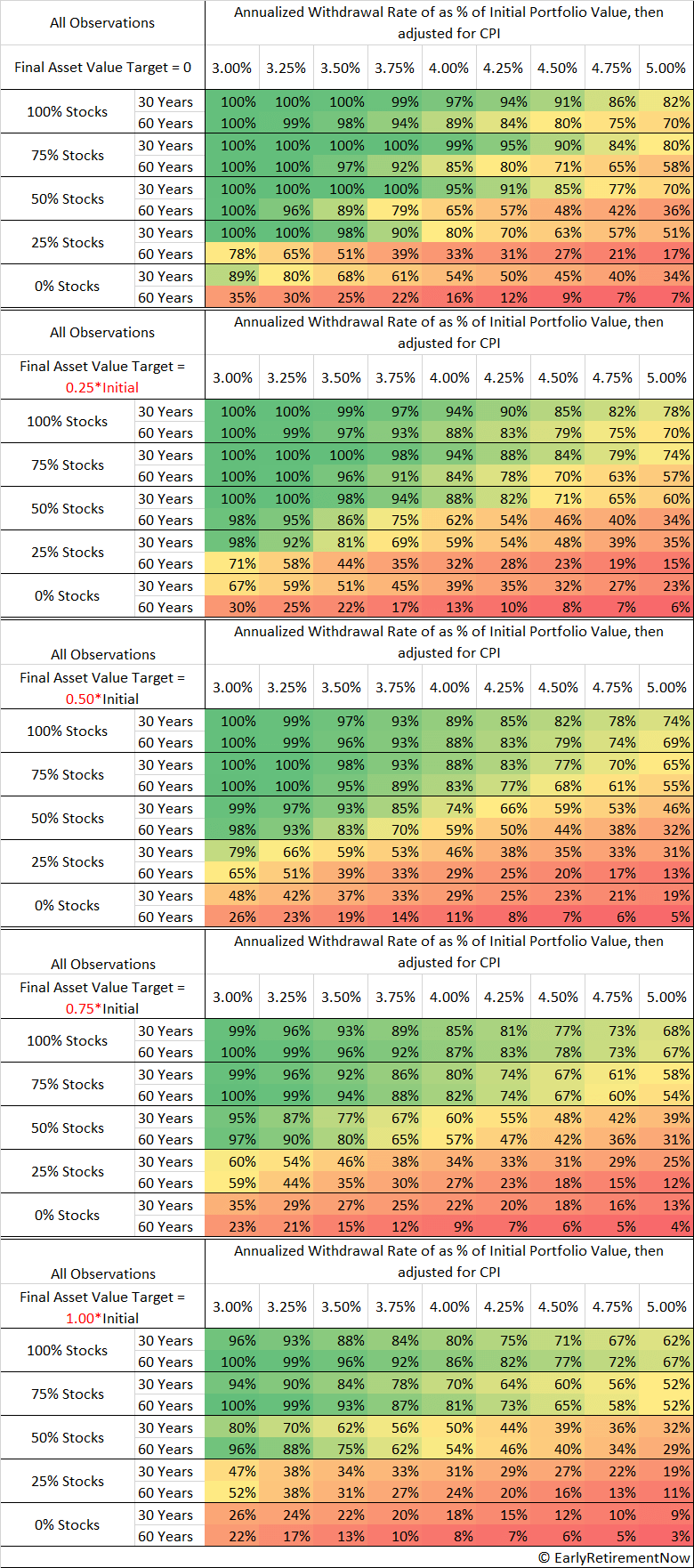

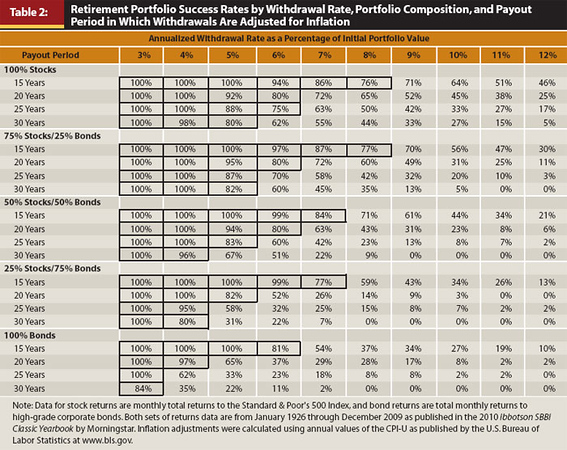

tyler creator of the website portfolio charts did an article on safe withdrawal rates . tyler is also creator of the golden butterfly portfolio.

one of the problems i see in the article is the term safe withdrawal rate is based on retiring in the worst of times which were 1907, 1939, 1937 , 1965 and 1966

all the references in the article start at 1970 which actually misses the worst of times which was 1965/1966 .

really the article in my opinion is about a withdrawal rate but not necessarily what we consider a safe withdrawal rate

https://portfoliocharts.com/2024/03/15/how-to-harness-the-flowing-nature-of-withdrawal-rate-math/

https://www.kitces.com/blog/what-returns-are-safe-withdrawal-rates-really-based-upon/

one of the problems i see in the article is the term safe withdrawal rate is based on retiring in the worst of times which were 1907, 1939, 1937 , 1965 and 1966

all the references in the article start at 1970 which actually misses the worst of times which was 1965/1966 .

really the article in my opinion is about a withdrawal rate but not necessarily what we consider a safe withdrawal rate

https://portfoliocharts.com/2024/03/15/how-to-harness-the-flowing-nature-of-withdrawal-rate-math/

https://www.kitces.com/blog/what-returns-are-safe-withdrawal-rates-really-based-upon/

Last edited: