DrRoy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

There have been lots of discussions about WR in RE. I do believe that while 4% has been an old standby, in the future with very low interest rates and slower economic growth 4% does not work reliably enough. This article offers an approach that I have not heard before and I thought it was interesting.

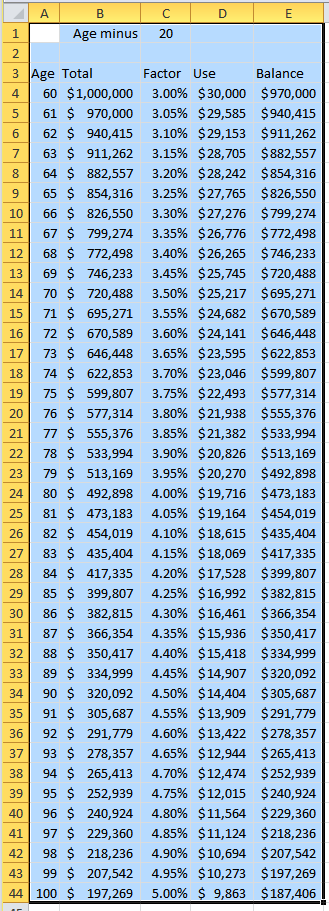

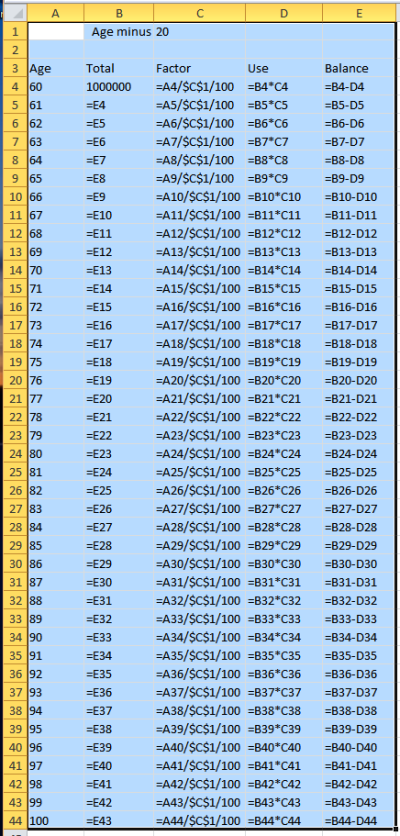

New retiree withdrawal rate: Goodbye 4%, hello age divided by 20

New retiree withdrawal rate: Goodbye 4%, hello age divided by 20