Spanky

Thinks s/he gets paid by the post

stock 53.79%

bond 32.31%

cash 13.90%

planning to increase equity to 60%.

bond 32.31%

cash 13.90%

planning to increase equity to 60%.

One accusations made about many of the supposed stock-picking funds is that they are "closet indexers." IOW their complex portfolios are deliberately or inadvertently designed to mimic a total market fund while they collect a premium fee for doing so.... I have a more complex mix than most (10 ETFs/MFs) with the following spread:

Morningstar Category; AA (%); Investment

Large Growth; 9; SCHG

Large Blend (S&P 500); 20; SWPPX

Large Value; 9; SCHD

Mid Cap Blend; 9; SCHM

Small Blend; 8; SCHA

Foreign Large Blend; 10; SCHF

Intermediate-Term Bond; 22; SCHZ

Realestate; 10; SCHH

Gold (Commodities Precious Metals); 1; SGOL

Inflation Protected Bond; 2; SCHP

In the long run, it probably doesn't make much difference between my AA and those with the simple 3 Vanguard fund spread, but I enjoy managing my portfolio and don't mind the extra work to re-balance.

AA depends on lots of things, age being one of the least important. Among them are: Size of assets relative to retirement income needs, goal for the assets (spend all, leave a sizeable estate, etc.), and your battle-tested* risk tolerance.

I think you'll do fine. DW and I have found that each "oops" is easier to ignore than the previous one. We were close to 100% equities before retiring but now have arranged our AA so we should be able ride the waves without SORR issues. I'm sure you will too.... it's too soon to know whether I'll shrug off a bear as easily as I had done while w*rking.

I'm about 6 weeks from retirement at 61, with AA of 80/15/5. It occurs to me that I don't really know my "battle-tested risk tolerance", because for the past 40 years I've been drawing a steady paycheck. My high equity fraction could weather any market storms without much worry.

Market went up? The numbers on my 401k summary page went up and I basked in the glow. Market went down? Equity prices declined so my contribution + match bought more shares that month.

But after the paychecks stop, the next time markets get spooky will provide some insight into just how much volatility I can stomach. We still will have a buffer with pensions and DW's SS covering 80% of our living expenses, but it's too soon to know whether I'll shrug off a bear as easily as I had done while w*rking.

Age 54, first year of retirement, no pension, asset allocation as of today:

74.4% Cash/CD/MM/Savings/Checking

16.1% Stocks/Equity

8.40% REIT's

1.10% Bond Funds

There are a lot of different schools of thought on what to do once you're out of the accumulation stage and into the ER/preservation stage, and the two phases can be very different.

Some pretty learned guys like Rick Ferri and Michael Kitces among others are not only comfortable with relatively low equity allocations in ER, but actually recommend it. Ferri, for example, says the "sweet spot" for those in early or normal retirement is ~35% equities. Kitces has recommended his "bond tent" approach where you have lower equities earlier in retirement, then raise the equity exposure once you're out of the ER years with reduced SOR risk and SS or other income streams come online.

If (like me), you expect the market to drop heavily in the next year or two, there's no sense exposing yourself to lots of market risk unless you "need" to. If you have a plan that pays the bills and helps bridge you to SS that doesn't require a high allocation to equities, it can in some situations make sense to lower your risk, get to SS, THEN re-assess how much you want to "let ride" on stocks to fund later years of spending.

Or course, I could be totally wrong, and the Dow could rocket to 30K+ and keep going without ever visiting the mid 20K levels again. But I do expect a big drop in the next year or two, and it's very likely that we'll see levels on the Dow below where we are now in that time. So, why watch your portfolio drop 30-50% AGAIN, like it did in 2008 unless you absolutely need to take that level of equity risk to meet your goals? Stock valuations are at all-time highs, the bull is one of the longest in history, and we have an election year coming up. All that together doesn't bode well IMHO for equities in 2020, current run-up aside..

Stocks are claims on future earnings and deserve a higher risk premium than bonds that pay a known interest rate and return principal at maturity. Uncertainties surrounding future earnings make stock prices much more volatile than bonds and can result in bear markets that last several years. Investors who are working and accumulating assets can weather these periods of uncertainty and benefit from a higher allocation to stocks. That’s not the case with someone living off their investments.

^ Thanks for the link. I generally agree with Ferri’s position.

But like we have discussed, there are a lot of factors at play here. Not just age and position in the retirement term. All personal circumstances define risk in the allocation.

I think there is a bit of hyperbole in the quote you referenced. Over time stocks are not "much more volatile than bonds"and obviously stocks carry more uncertainty. That's why over time they dwarf the returns bonds have provided.

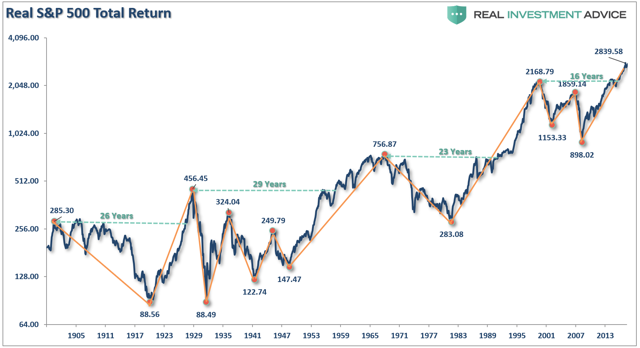

I agree - his comment on bear market longevity was a little extreme - just to support his position I suppose.Also, his comment that bear markets can "last several years" is not true. Possible? sure, but bear markets on average last about 18 months.

I think there is a bit of hyperbole in the quote you referenced. Over time stocks are not "much more volatile than bonds"and obviously stocks carry more uncertainty. That's why over time they dwarf the returns bonds have provided.[ /QUOTE]

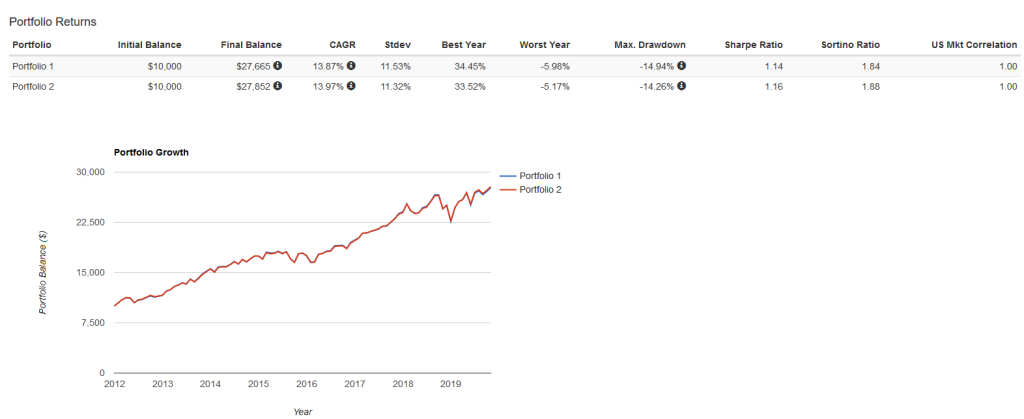

As part of my allocation research, I checked returns since inception between Vg Total Stock and Total Bond funds. Total Stock is 6.87. total Bond is 4.26. These are average returns, so the numbers don’t really address volatility. But I was surprised that the bond fund return was that close to the stock fund return.

That seems about right. Over a 10 year time frame a million dollars in stocks at 6.87% gives you almost 2 million . At 4.26 you have about 1.5 million. 2X the return.

I think there is a bit of hyperbole in the quote you referenced. Over time stocks are not "much more volatile than bonds"and obviously stocks carry more uncertainty. That's why over time they dwarf the returns bonds have provided.

Also, his comment that bear markets can "last several years" is not true. Possible? sure, but bear markets on average last about 18 months.