HELP - AA / Portfolio for Soon to Be Early Retiree

Over the next several months I will divest from a concentrated position into a diversified portfolio. The goal is to completely divest the position and join the class of 2014!!! I have to figure out my asset allocation and retirement portfolio.

I am 48, DW is 50. I am figuring on a 45 year retirement. As long as everything holds together, we will end up at 35x when done. That doesn't include social security. As long as Congress doesn't change our benefits, SS would cover 23% of our expenses if taken at 62 and 42% of our expenses if taken at 70. I ran several retirement calculators with 35x and early SS and we have the green light. I'll probably take late SS though.

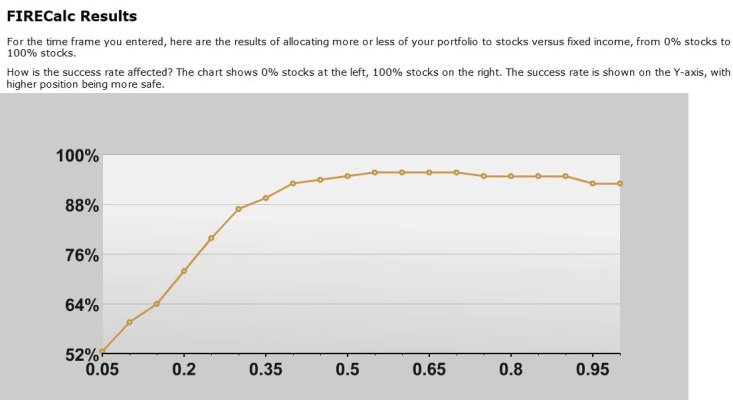

My first inclination was to have an asset allocation of 75% equities / 25% bonds. After reading Dr. Pfau's work on sequence of return risk I thought I might adjust it to be something like 25% equities / 75% bonds - especially because I've got fear of heights having just been on a roller coaster and given the markets are at all-time highs.

As far as types of accounts here is our situation as it relates to annual expenses.

Vanguard suggested the following allocation.

28% Vanguard Total Stock Market ETF (VTI)

12% Vanguard Total International Stock ETF (VXUS)

48% Vanguard Total Bond Market ETF (BND)

12% Vanguard Total International Bond ETF (BNDX)

Thoughts? It seems as good as anything I'd be able to come up with. I think I'd sleep ok for the short term, but it really cuts against the articles that indicate I should be at 70 to 80% stock allocation based on my age. Too conservative?

I will be divesting equally from all 3 types of accounts and making purchases as I divest into whatever allocation I end up going with. This will sort of be like DCA into the markets over 4 months.

How should I be allocating the money across accounts though. Balanced proportionally? I don't think I'd want all VTI in my taxable account because then I'd be 100% in stocks for what I can access until DW turns 59.

If for some reason our Taxable account doesn't last, we do have 4x in the Roth that we can take out early without penalty since it was our initial investment and has been there 5 years.

I thought I had a good handle on all this earlier in the year. Now that I'm going to start executing on it this month, I'm getting anxious.

Over the next several months I will divest from a concentrated position into a diversified portfolio. The goal is to completely divest the position and join the class of 2014!!! I have to figure out my asset allocation and retirement portfolio.

I am 48, DW is 50. I am figuring on a 45 year retirement. As long as everything holds together, we will end up at 35x when done. That doesn't include social security. As long as Congress doesn't change our benefits, SS would cover 23% of our expenses if taken at 62 and 42% of our expenses if taken at 70. I ran several retirement calculators with 35x and early SS and we have the green light. I'll probably take late SS though.

My first inclination was to have an asset allocation of 75% equities / 25% bonds. After reading Dr. Pfau's work on sequence of return risk I thought I might adjust it to be something like 25% equities / 75% bonds - especially because I've got fear of heights having just been on a roller coaster and given the markets are at all-time highs.

As far as types of accounts here is our situation as it relates to annual expenses.

Code:

Taxable - 7.5x

IRA - 2.0x

ROTH - 25.5xVanguard suggested the following allocation.

28% Vanguard Total Stock Market ETF (VTI)

12% Vanguard Total International Stock ETF (VXUS)

48% Vanguard Total Bond Market ETF (BND)

12% Vanguard Total International Bond ETF (BNDX)

Thoughts? It seems as good as anything I'd be able to come up with. I think I'd sleep ok for the short term, but it really cuts against the articles that indicate I should be at 70 to 80% stock allocation based on my age. Too conservative?

I will be divesting equally from all 3 types of accounts and making purchases as I divest into whatever allocation I end up going with. This will sort of be like DCA into the markets over 4 months.

How should I be allocating the money across accounts though. Balanced proportionally? I don't think I'd want all VTI in my taxable account because then I'd be 100% in stocks for what I can access until DW turns 59.

If for some reason our Taxable account doesn't last, we do have 4x in the Roth that we can take out early without penalty since it was our initial investment and has been there 5 years.

I thought I had a good handle on all this earlier in the year. Now that I'm going to start executing on it this month, I'm getting anxious.

Last edited: