Here's an interesting article about the dangers of investing in bonds at the present time:

Bonds: So Much More Dangerous Than You Think

The article concludes with the following question?

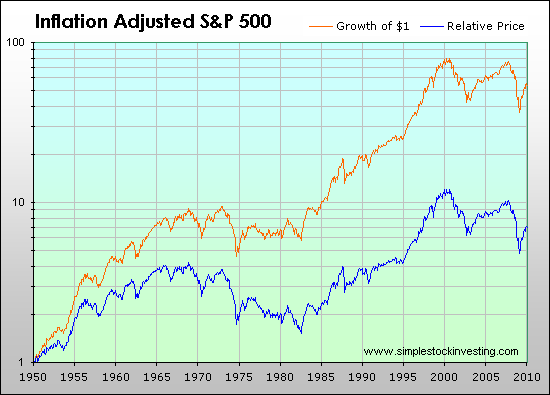

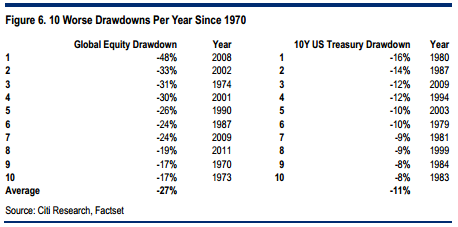

At a conference two years ago, Wharton finance professor Jeremy Siegel laid out the history of stocks and bonds to a roomful of journalists: "You have never lost money in stocks over any 20-year period, but you have wiped out half your portfolio in bonds. So which is the riskier asset?"

The question answers itself.

What do you think?

Bonds: So Much More Dangerous Than You Think

The article concludes with the following question?

At a conference two years ago, Wharton finance professor Jeremy Siegel laid out the history of stocks and bonds to a roomful of journalists: "You have never lost money in stocks over any 20-year period, but you have wiped out half your portfolio in bonds. So which is the riskier asset?"

The question answers itself.

What do you think?