But, but, but the same article says that while stocks were bad during high inflation years, bonds were worse.

"In an article in the 2012 Credit Suisse Global Investment Returns Yearbook, they found that during periods of "marked" inflation, equities easily outperform bonds, probably the worst investment to own during inflationary episodes. Yet equities gave a real return of -12% during those periods, while bonds lost 23.2%. Double ouch."

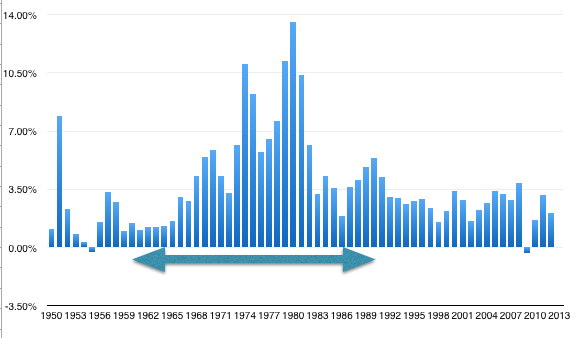

However, that only applies to really high-inflationary periods of greater than 5%, of which Siegel had the following to say.

"Although stocks do well when annual inflation is in the range of 2% to 5%, their performance begins to falter when inflation exceeds 5%."

Why? Because "companies can't always pass along increased costs, especially in the case of an important raw material, such as oil. As a result, many companies will see their profits squeezed," he wrote.

Siegel's conclusion: "Stocks are not good short-term hedges against rapidly increasing inflation, but bonds are worse."

When inflation goes above 5%, perhaps the only safe things to hold will be gold and commodities. Until that happens, I will still be holding stocks. Now, what do I do with the cash that I have been holding in lieu of bonds? Long-term treasuries have been beaten down bad, but the yield is still too low to interest me though.