Anyone make a big ticket purchase using a points credit card? I'm getting ready to buy a boat and wonder if I can buy it with a Chase Sapphire Visa, then pay it off immediately for the point value.... I don't know if the boat dealer would allow it because he might have to pay a large fee to Visa.. anyone know how this might or might not work?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Buy a boat with a credit card?

- Thread starter Tailgate

- Start date

REWahoo

Give me a museum and I'll fill it. (Picasso) Give

You can always ask, but my experience is big ticket retailers place limits on how much of a purchase they will allow on a CC. I once tried buying a car with a CC and the dealership wouldn't agree to more than $3k on the card.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Same here. I tried to buy my last car using a CC for the points, dealer would not allow it even though it was well within our credit limit. I assume it's because merchants have to pay CC companies on average 2% of transaction cost and car-boat and other big ticket item sellers want cash without out any middleman %. A 2% cut on a car or a boat by a credit card issuer is unwarranted.You can always ask, but my experience is big ticket retailers place limits on how much of a purchase they will allow on a CC. I once tried buying a car with a CC and the dealership wouldn't agree to more than $3k on the card.

Last edited:

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

It might be worth looking into. Can't hurt to ask. They might be willing to negotiate you paying a bit more in which case you would have to assess the value of the points to you.

Another benefit of a CC transaction is that some providers double the term of the manufacturer's warranty. I got money back from Discover for some out-of-warranty refrigerator repairs because I bought the refrigerator using my Discover card. But I suspect that there may be limitations but if not it would be fun to see there faces when someone files a claim for repairs on an x year old boat!!!

Another benefit of a CC transaction is that some providers double the term of the manufacturer's warranty. I got money back from Discover for some out-of-warranty refrigerator repairs because I bought the refrigerator using my Discover card. But I suspect that there may be limitations but if not it would be fun to see there faces when someone files a claim for repairs on an x year old boat!!!

FANOFJESUS

Thinks s/he gets paid by the post

You can always ask, but my experience is big ticket retailers place limits on how much of a purchase they will allow on a CC. I once tried buying a car with a CC and the dealership wouldn't agree to more than $3k on the card.

I have heard that many times. The strange thing is you would think they could eat the 2% There can be a lot of profit on a used car.

Ready

Thinks s/he gets paid by the post

It might be worth looking into. Can't hurt to ask. They might be willing to negotiate you paying a bit more in which case you would have to assess the value of the points to you.

Another benefit of a CC transaction is that some providers double the term of the manufacturer's warranty. I got money back from Discover for some out-of-warranty refrigerator repairs because I bought the refrigerator using my Discover card. But I suspect that there may be limitations but if not it would be fun to see there faces when someone files a claim for repairs on an x year old boat!!!

Credit cards all have disclaimers that they do not extend warranties on motorized vehicles of any type...including boats.

sanfanciscotreat

Recycles dryer sheets

- Joined

- May 19, 2011

- Messages

- 325

I have paid up to $5000 on the purchase of a car on a credit card.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Credit cards all have disclaimers that they do not extend warranties on motorized vehicles of any type...including boats.

Good to know.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

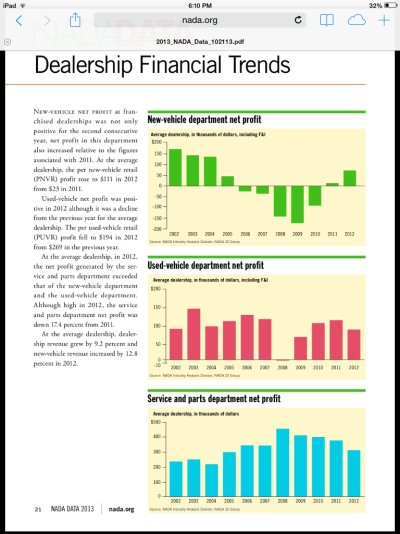

You might be surprised, (as I'd always heard) it appears most dealers profit quite a bit more on service & parts than profits on new or used cars even after F&I. Despite the rare buyer who pays MSRP (or close), the average profit on new cars is by one report about 3% (before holdbacks & incentives), which would explain why dealerships can't eat a 2%+ CC fee...I have heard that many times. The strange thing is you would think they could eat the 2% There can be a lot of profit on a used car.

Attachments

Last edited:

We paid off our house with a credit card. I think it was about $16,000 but it was a balance transfer deal, not a merchant transaction. There was no balance transfer fee and a fixed 2.99% rate for 1 year, then 1.99% for the life of the balance. Paid that off before DH retired.

mickeyd

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I once purchased a used car from AutoNation USA with a CC and paid it off the next month. I think I got about $80 in Discover cashback credits.

I have asked to do it again but they don't seem to want to get my CC money now.

I have asked to do it again but they don't seem to want to get my CC money now.

Last edited:

bssc

Moderator Emeritus

- Joined

- Dec 27, 2005

- Messages

- 10,125

I am another person who bought a used car. Used a cash back card and put the entire 8000 on it. Paid it off in full before any interest was charged.

Amethyst

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Dec 21, 2008

- Messages

- 12,668

It's always worth asking, as others have said. We have been having a lot of big expenses related to 3 properties, and I always ask if I can put some or all on the CC. Most contractors want a check because the CC fee cuts into their profits, but some will go for it (because CC's don't bounce, I guess).

Our utilities and taxing authorities allow CC payments, but the fee is not worth the convenience or the points.

Re: new car, the dealer would only let us put $3K on the CC and was unhappy even about that.

Amethyst

Our utilities and taxing authorities allow CC payments, but the fee is not worth the convenience or the points.

Re: new car, the dealer would only let us put $3K on the CC and was unhappy even about that.

Amethyst

Lakedog

Full time employment: Posting here.

- Joined

- May 23, 2007

- Messages

- 984

I once bought a new Toyota truck with a Visa card (only about $15000) but that was many years ago. Since then, I have tried to buy boats/autos that way but have not found another dealer that would allow more than a couple thousand by CC.

HawkeyeNFO

Thinks s/he gets paid by the post

If you're slightly creative, there are ways to "buy money" at face value using your credit card, and then spend that money on whatever you'd like.

One reason that dealerships don't like to take a lot of money on a credit card is that they become vulnerable to a disputed charge, which is work for them to counter-dispute, and no guarantee that they will win the dispute.

One reason that dealerships don't like to take a lot of money on a credit card is that they become vulnerable to a disputed charge, which is work for them to counter-dispute, and no guarantee that they will win the dispute.

ducky911

Recycles dryer sheets

- Joined

- May 18, 2010

- Messages

- 497

You can get two different answers to this question.

Try this one.

Just tell them you are not going to buy the boat if you can not put it on the credit card and get up and start to walk out.

Try this one.

Just tell them you are not going to buy the boat if you can not put it on the credit card and get up and start to walk out.

OAG

Thinks s/he gets paid by the post

Used CC for $10,000 on last car purchase. Probably could have argued for more.

For any purchase, at any amount, where the seller takes credit cards, negotiating the 2% is becoming common. Not from major retailers, but for those with a direct vested interest in making the sale.

Doesn't work with most major retailers. Brings up a very interesting subject for me. With a retail background in one of the (then) largest companies in the world, management controls went down to the local level... with the store manager having the authority to make decisions in the interest of profit and customer relations.

Today, not so much. Personal example... second largest building/home garden company in the country.

Recently went to purchase approximately $1,000 in furniture. Half hour with the salesperson, and after settling on what we wanted, asked about delivery charges. Salesperson and department manager both quoted a price and completed the sales form. We brought it to the "delivery" department, where they revised the delivery charge by upping the price by $10... a recent (yesterday) change. When I complained, instead of giving a courtesy $10 allowance to keep the sale, they refused to do this... I asked to speak to the manager, as I thought he'd want to keep a good customer... as well as the obvious profit.

"No way"...

So we left. The more I thought about it, the more I thought of how wasteful their policy was, so wrote a letter to the president of the corporation, asking if that was indeed their attitude and policy. I did receive a reply... which said they were sorry that I was disappointed, but that their manager had acted in accordance with their corporate instructions.

Policy trumps sanity...

Doesn't work with most major retailers. Brings up a very interesting subject for me. With a retail background in one of the (then) largest companies in the world, management controls went down to the local level... with the store manager having the authority to make decisions in the interest of profit and customer relations.

Today, not so much. Personal example... second largest building/home garden company in the country.

Recently went to purchase approximately $1,000 in furniture. Half hour with the salesperson, and after settling on what we wanted, asked about delivery charges. Salesperson and department manager both quoted a price and completed the sales form. We brought it to the "delivery" department, where they revised the delivery charge by upping the price by $10... a recent (yesterday) change. When I complained, instead of giving a courtesy $10 allowance to keep the sale, they refused to do this... I asked to speak to the manager, as I thought he'd want to keep a good customer... as well as the obvious profit.

"No way"...

So we left. The more I thought about it, the more I thought of how wasteful their policy was, so wrote a letter to the president of the corporation, asking if that was indeed their attitude and policy. I did receive a reply... which said they were sorry that I was disappointed, but that their manager had acted in accordance with their corporate instructions.

Policy trumps sanity...

This will sound strange, but my dear friend paid for her son's funeral on a credit card. She is frugal and so was he. He would have gotten a kick out of her receiving the points and paying balance in full of course.

great story!

Pajaro

Recycles dryer sheets

In Dec 2011 I bought a used Passat from a new car dealer and put the whole thing ($18,500) on a credit card. I negotiated the total price before we talked about payment methods, so I know they didn't raise the price to include the transaction fee.

I am military and they knew I was putting the car on a boat the next day to ship to my next duty station in Europe, so I had to have the title and the car that day and couldn't wait even 24 hours. When it came time to pay I explained that my bank's closest branch was 7 hours away, so I couldn't get a cashier's check in time. I gave them 2 options: they could either accept a personal check from me or they could let me put the whole thing on a CC. They took the CC...

I am military and they knew I was putting the car on a boat the next day to ship to my next duty station in Europe, so I had to have the title and the car that day and couldn't wait even 24 hours. When it came time to pay I explained that my bank's closest branch was 7 hours away, so I couldn't get a cashier's check in time. I gave them 2 options: they could either accept a personal check from me or they could let me put the whole thing on a CC. They took the CC...

Pajaro

Recycles dryer sheets

I'm sure there were lots of other options besides the two I offered, but I wasn't going to volunteer them. And yes, I paid off the credit card the next day!

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

You didn't want to wait for the bill and then pay it on the due date and get 20-50 days of float? (Not that float is all that valuable these days).

Pajaro

Recycles dryer sheets

I would have waited, but I really was moving overseas. It's a pretty chaotic experience (I've moved back and forth 5 times), and I wanted to tie up every possible loose end ASAP so I could focus on finding a house, etc.

Similar threads

- Replies

- 32

- Views

- 845

- Replies

- 23

- Views

- 662