dixonge

Thinks s/he gets paid by the post

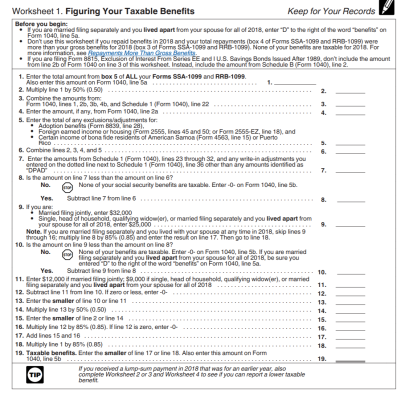

I finally found my 'savings' spreadsheet where I attempt to project annual income from pension and SS, including calculating SS taxes, etc. I adjusted some numbers that have changed, but I am unsure if I am calculating the SS taxes correctly. Google has been unhelpful

So here is what I have, would appreciate if anyone has an excel formula for this or corrections to my info:

Maximum tax bracket is 12% for forseeable future

SS income * .5 then add pension income then subtract 44,000 then take all that and multiply by .85 and the result should be the taxable portion of SS. Does that sound about right?

So here is what I have, would appreciate if anyone has an excel formula for this or corrections to my info:

Maximum tax bracket is 12% for forseeable future

SS income * .5 then add pension income then subtract 44,000 then take all that and multiply by .85 and the result should be the taxable portion of SS. Does that sound about right?