@Texas Proud, bamsphd: To clarify, I am NOT saying it's the same set of stocks that will never change. Of course I realize small companies will become large and large companies will become small. Some value companies will become growth and vice versa.

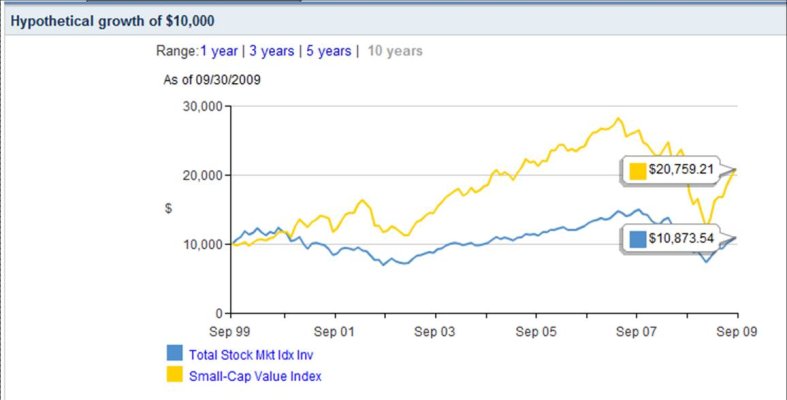

Please take a look at my example again. It's really really simple: Person A buys 10k worth of small value index fund (e.g. VISVX) and holds it forever. Person B buys 10k worth of total US market index (e.g. VTSMX) fund and also holds it forever. (And yes, all dividends / cap gains are reinvested.)

These are real funds. Obviously the funds will kick out no-longer qualifying stocks and start buying other ones. I am not disputing this in any way.

My question (1) is - do you believe Person A will outperfom Person B?

Question (2): If you answered yes to (1), do you see any issue with the following paragraph of my example: "If you believe that over long period of time person A's fund will grow at the rate of 9% and person B's fund will grow at the rate of 8%, then eventually (240 years from now) person A's holding will be 90% of combined person A and person B's holding."

Thank you for your responses

Please take a look at my example again. It's really really simple: Person A buys 10k worth of small value index fund (e.g. VISVX) and holds it forever. Person B buys 10k worth of total US market index (e.g. VTSMX) fund and also holds it forever. (And yes, all dividends / cap gains are reinvested.)

These are real funds. Obviously the funds will kick out no-longer qualifying stocks and start buying other ones. I am not disputing this in any way.

My question (1) is - do you believe Person A will outperfom Person B?

Question (2): If you answered yes to (1), do you see any issue with the following paragraph of my example: "If you believe that over long period of time person A's fund will grow at the rate of 9% and person B's fund will grow at the rate of 8%, then eventually (240 years from now) person A's holding will be 90% of combined person A and person B's holding."

Thank you for your responses