Over the last several years, I got a number of merchant credit cards because of their one time cashback promotions. All payments due were always paid on time and in full. Now, most of these cards are not being used. What will cancelling these cards do to my FICO score? I currently have a pretty high score and I would like to raise it even further.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Cancelling credit cards and FICO score

- Thread starter MJ

- Start date

SumDay

Thinks s/he gets paid by the post

- Joined

- Aug 9, 2012

- Messages

- 1,862

Keeping them and not carrying a balance will do more for your score than cancelling them. It's your debt to "credit available" ratio is kind of a big deal, or so I've been told. We have well over $100K available, and never carry more than $1K for a week or so.

http://www.myfico.com/CreditEducation/WhatsInYourScore.aspx

http://www.myfico.com/CreditEducation/WhatsInYourScore.aspx

Sunset

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Merchant cards (store cards) are pretty lousy with low limits, and usually low cashback offers.

So if you have 3 or more regular credit cards, then feel free to cancel a couple of the store ones. If you don't have regular credit cards, then get some first and next year cancel the store ones.

So if you have 3 or more regular credit cards, then feel free to cancel a couple of the store ones. If you don't have regular credit cards, then get some first and next year cancel the store ones.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Keeping them and not carrying a balance will do more for your score than cancelling them. It's your debt to "credit available" ratio is kind of a big deal, or so I've been told. We have well over $100K available, and never carry more than $1K for a week or so.

FICO Credit Score Chart: How credit scores are calculated

Long term credit is a plus, but lots of accounts is a minus.

SumDay

Thinks s/he gets paid by the post

- Joined

- Aug 9, 2012

- Messages

- 1,862

Long term credit is a plus, but lots of accounts is a minus.

My credit score is 830.

Bamaman

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I just let old unused credit cards hang--not cancelling them.

And I could care less (within reason) what my FICO score is, as I don't intend to ever borrow any money in the future.

What gets me is that my wife always has the higher FICO score--and she's been unemployed for 15 years. Go figure. She's the one that gets all the offers in the mail.

And I could care less (within reason) what my FICO score is, as I don't intend to ever borrow any money in the future.

What gets me is that my wife always has the higher FICO score--and she's been unemployed for 15 years. Go figure. She's the one that gets all the offers in the mail.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Long term credit is a plus, but lots of accounts is a minus.

The bolded part above is inaccurate.

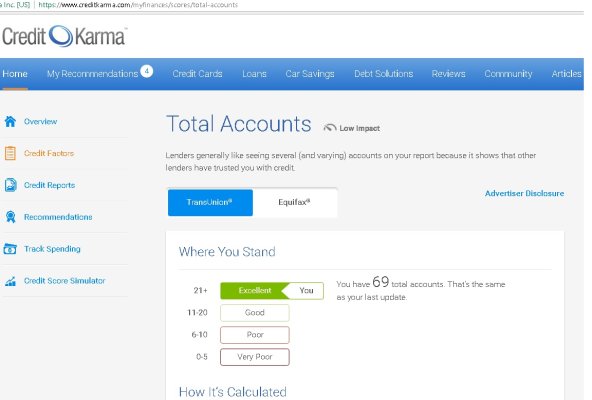

I have 69 total accounts on TransUnion and a Vantage 3.0 credit score of 835. According to CreditKarma, more accounts are better, not worse.

I've tried to attach a screen shot.

Attachments

Last edited:

travelover

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 31, 2007

- Messages

- 14,328

Insurance companies use your credit score to set your individual rates...........And I could care less (within reason) what my FICO score is, as I don't intend to ever borrow any money in the future.................

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The bolded part above is inaccurate.

I have 69 total accounts on TransUnion and a Vantage 3.0 credit score of 835. According to CreditKarma, more accounts are better, not worse.

I've tried to attach a screen shot.

I was told that by a banker. They will add x dollars per card to your credit load to determine your credit worthiness.

Sunset

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I was told that by a banker. They will add x dollars per card to your credit load to determine your credit worthiness.

What is x ? and if their algorithm does not consider the number of cards, and income level, it's pretty simplistic.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

What is x ? and if their algorithm does not consider the number of cards, and income level, it's pretty simplistic.

x = a dollar amount. For example they would assume you would have $50 per card per month. So if you have 30 cards, they assume you could have $1500 in card payments per month. That is the way it was explained to me. So in that case more cards was a negative. Just what I was told.

The bolded part above is inaccurate.

I have 69 total accounts on TransUnion and a Vantage 3.0 credit score of 835. According to CreditKarma, more accounts are better, not worse.

I've tried to attach a screen shot.

I'm running at 820-830 and my credit report says I should have more lines of credit, it recommended 18. 69 seems maybe a bit much..but for me thats just because having to track them all and ensure no fraud is too much of a hassle for me.

If they are major credit cards I'd just keep them, I have a discover card I used once in the last 8 years but has a decent line of credit so its a plus. However, if you have a store credit and you use it it could actually be a minus as they look at overall and individual limits.. so if you have a $500 store card and happen to charge $400, if they happen to run the report at that time (since its only a snapshot), it would show you are above a high water mark and could cost you a few points... obviously anything above 780 is really the same..but it seems you'd like to try for 850 so just something to keep in mind.

Insurance companies use your credit score to set your individual rates.

I know that's illegal in California. Do most other states allow it?

My credit score took a 15-20 point hit because of the Costco changeover. AMEX dropped off my report, shortening my average credit history and Costco Citi hasn't yet shown up on the report. I'm guessing they haven't figured out how to report the Costco card with the AMEX history. This should give you an idea of what will happen when you cancel a card with a long history and high credit limit. If the cards you want to cancel are on the short end of your history, it might help your score, as long as your utilization doesn't put you into the next lower grouping.

SumDay

Thinks s/he gets paid by the post

- Joined

- Aug 9, 2012

- Messages

- 1,862

I know that's illegal in California. Do most other states allow it?

Consumer Alert: Credit-Based Insurance Scores

Mine does (flyover state)

Sunset

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

x = a dollar amount. For example they would assume you would have $50 per card per month. So if you have 30 cards, they assume you could have $1500 in card payments per month. That is the way it was explained to me. So in that case more cards was a negative. Just what I was told.

I was wondering what value he actually told you, as $1,500 would not be much for someone pulling in 80K /yr, but might be a bit much for 15K/yr person.

So if it's a flat rate, I agree 69 CC would be a lot.

Personally I only have about 8, never really counted them, and could go up a few more no fee ones just for the hotel benefits, in case we ever stay at that hotel chain. I would not want over 20 CC's as it sounds like work.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I was wondering what value he actually told you, as $1,500 would not be much for someone pulling in 80K /yr, but might be a bit much for 15K/yr person.

So if it's a flat rate, I agree 69 CC would be a lot.

Personally I only have about 8, never really counted them, and could go up a few more no fee ones just for the hotel benefits, in case we ever stay at that hotel chain. I would not want over 20 CC's as it sounds like work.

I think they told me they assume the minimum payment amount for each card.

Insurance companies use your credit score to set your individual rates.

I know that's illegal in California. Do most other states allow it?

I think most states do, at least WV allows it.

It makes sense to do so because the underlying issue is personal responsibility. The insurance companies have the relationship between accident rates and credit scores well documented. Some people (presumably those with low scores) are infuriated by the practice. Since I have a high score I think it is a good idea.

I think most states do, at least WV allows it.

It makes sense to do so because the underlying issue is personal responsibility. The insurance companies have the relationship between accident rates and credit scores well documented. Some people (presumably those with low scores) are infuriated by the practice. Since I have a high score I think it is a good idea.

Illinois and NC allow it too.. however, its actually NOT true there is a relationship.. the credit companies have finally fessed up that the claims there is were never proven and have been pushing it for years because well.. that means every insurance company will need to pay to pull a report...its also why it started getting tied to jobs, etc. honestly I think the FICO scores tells you basically nothing...sure being able to see if people are delinquent, yeh that tells you they are broke so don't borrow them more money; however other than that its useless.

It severely punishes low income, less educated people. ie my sister turns 18, gets a job right away applies for a CC, gets denied as she has no credit history so can only take out secured credit which doesn't actually count towards your credit score. I turn 18, go to college, have no job, have student loans, get 3 credit cards immediately..with zero effort. You have plenty of people who pay cash because they don't want to pay interest.. why would those people make bad employees or bad drivers? Its a rigged system, yes i know how to play the game, heck I took someone that filed bankruptcy and playing the system within 2 years had them into the above average FICO score range... btw, they are NOT a good credit risk even with a score in the high 700s and they did get in a car accident this year costing $8k to the insurance company.. but that credit score didn't tell them anything because its easily manipulated.

SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I'm running at 820-830 and my credit report says I should have more lines of credit, it recommended 18. 69 seems maybe a bit much..but for me thats just because having to track them all and ensure no fraud is too much of a hassle for me.

If they are major credit cards I'd just keep them, I have a discover card I used once in the last 8 years but has a decent line of credit so its a plus. However, if you have a store credit and you use it it could actually be a minus as they look at overall and individual limits.. so if you have a $500 store card and happen to charge $400, if they happen to run the report at that time (since its only a snapshot), it would show you are above a high water mark and could cost you a few points... obviously anything above 780 is really the same..but it seems you'd like to try for 850 so just something to keep in mind.

I should clarify that I have 69 total accounts, but 50 of those are closed. I "only" have 19 open at the moment. I play credit card games (currently travel hacking and tradeline piggybacking) to earn a few thousand dollars extra per year so that is why I have so many.

It's not something I would necessarily recommend; I was just using my data as a counterexample about the number of open accounts.

I don't really care what my credit score is. I'm retired, debt-free except for my credit card games, have no plans to borrow money for anything, and I think mine is high enough to avoid higher insurance rates on the insurance that I carry.

ownyourfuture

Thinks s/he gets paid by the post

- Joined

- Jun 18, 2013

- Messages

- 1,561

And I could care less (within reason) what my FICO score is, as I don't intend to ever borrow any money in the future.

I'm with you.

I'm not saying it's the case with anyone here @ ERF, but I've read articles in the past (may have been SmartMoney magazine) where people became obsessed with their credit rating, & the vast majority of the time, the people that obsessed the most, were those that didn't really have to worry about it.

daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

We started opening cards for the sign up bonuses last year and closed them all after a year. We did maybe 3 each over the year and it never seemed to make much of a change in our credit scores. I just checked Discover's FICO score table for the past year and it doesn't show any major changes for card opening or closing events.

Last edited:

Sunset

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

When I had no credit score, I opened a secured credit card, and it does count towards your credit score. Three months or four months after having it, I went back to the same bank and said I wanted a "real" credit card.

They gave me one, and took back the secured one.

They gave me one, and took back the secured one.

Sunset

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

We started opening cards for the sign up bonuses last year and closed them all after a year. We did maybe 3 each over the year and it never seemed to make much of a change in our credit scores. I just checked Discover's FICO score table for the past year and it doesn't show any major changes for card opening or closing events.

+1

Same thing, although I think I noticed when I opened a new one that my score slipped from 813 to 793 a couple of months ago, but has since climbed back up a few points.