Huston55

Thinks s/he gets paid by the post

OK, I need some constructively critical analysis here (not usually difficult to come by in these parts �� ); and I consider that a good thing BTW.

Question: Using the ‘prototypical E-R.org member, is it better to capture LTCG in the lower tax brackets of ER (ages 57-70ish) or to do Roth conversions?

Profile: Using info from recent polls & threads (Thx MidPack) plus some interpolation, we’ll use a prototypical “ERorg” member (we’ll call him “Yorg”):

Age=57, married

NW=$2.9M

AA=50/50 (earns 4%/yr real)

Asset Location=40% taxable/40% tax deferred/20% tax free

Annual Spend=$84k

WDR=3.4% ($99k)

Pension Income= $25k

SS=$64k/yr (assume maxed out, deferred to 70 & 1.5 times max earner)

Stipulations: (I think these are reasonable, and we need to prevent this from getting too complicated)

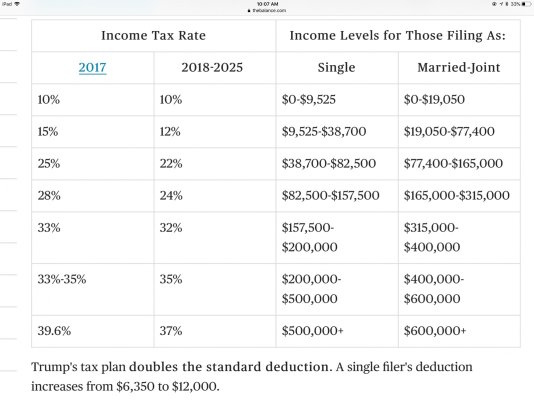

1. Nobody can tell the future so, we assume tax brackets will remain the same (posted at the bottom for easy reference)

2. Mr. & Mrs. Yorg will live to their actuarial ages because, again, nobody can tell the future [Note: this means that MFJ tax brackets apply for almost all years.]

3. Market returns will remain within historical ranges (ie: nothing crazy stupid outside typical secular bull/bear markets) because,...well, you know.

4. This analysis is relevant only for what we can choose to do in the ER years (57 - 70.5) because, that’s the only time one has the capacity to influence it with the methods being evaluated (how to best fill the various marginal tax buckets).

5. Mr. & Mrs. Yorg have no overriding legacy goals. [Note: Assuming otherwise could complicate this analysis significantly. So, for this analysis, please abide by this stipulation.]

6. Managing to ACA (or other income based) subsidies is not considered.

Discussion: (only the beginning I’m sure �� )

I’ve read many (most?) of the E-R.org threads on Roth conversions and, the consensus seems to be that it’s wise (ie: minimizes lifetime tax bite) to do Roth conversions up to the XX% bracket during the early retirement, low income, pre-RMD years. I’ve spent less time @ BH but, the consensus there seems to be the same. That makes intuitive sense to me but, when analyzing the sample situation, I just can’t get “Roth Conversions” to always be the best choice for for the “Yorgs.” I keep coming back to capturing zero tax LTCGs first.

To simplify all the ‘puts & takes’ of the various options, I chose a simple model (Complicated ones make my head hurt): In my model, I accept that the Yorgs have an existing tax liability and, if they do nothing, they will pay exactly those taxes for the remainder of their time, this is “neutral” (neither positive nor negative); I view this liability as a line from left to right with time on the horizontal axis (the line can be straight, rising or variable; whatever works for you but, it actually doesn’t make any difference). The Yorg’s goal is to be below the line, defined as avoiding their existing tax liability (saving spendable NW). So, if they save $5k in taxes in year one, they’re $5k ahead (“below the line”); do it again in year two & they’re $10k ahead, and so on.

So, I said I concluded that capturing zero tax LTCG is best for the Yorgs. Here’s how I concluded that. They can capture “X” LTCG (on top of any other income) up to ~$77k and avoid 15% of “X”; they’re now X(15%) below the line of their baseline tax liability. They could continue to do this for all the RE years until RMD time, and build up a substantial amount of tax avoidance (increased NW). What if they did a Roth Conversion instead? Using the new tax brackets below, I see they’d pay 11.5% on the conversion, meaning they’re (temporarily) X(11.5%) above the line. [Note: We know from Kitces & others that if marginal tax rates remain the same, this turns out to be a wash come RMD time. Remembering my stipulation #1 above, we’ll call Roth Conversion “a wash.”].

But, what about the fact that the Yorg’s marginal tax rate during RMD time will be higher than it is now? And, if they convert to Roths now, they’d avoid those taxes right? OK, let’s look at this. We now have a numerical target to determine if Roth Conversions are better; it’s X(15%) that we got from capturing zero tax LTCG. We’ll examine several tax bracket scenarios.

1. Up through 12% Bracket, Age 57-70:

Income = $25k (pension) + $25k (DVD + Int) - $24k (2 Deductions) = $26k

LTCG to fill 12% bucket:

Available headroom (rounding)= $77k - $26k = $51k

Savings = $51k(15%)=$8k

Roth Conversion to fill 12% bucket: Savings is zero (See above, it’s a wash)

Conclusion: filling bucket with LTCG is best choice

2. Up through 22% Bracket, Age 71:

Income = $25k (pension) + $25k (DVD + Int) + $64k (SS) + $73k (RMD) - $24k (2 Deducions) = $163k

Conclusion: Doing conversions (age 57-70) into the 22% bracket would save the Yorg’s nothing because they remain in the 22% bracket even with RMDs. Plus, they would have foregone the opportunity to capture zero tax LTCGs.

3. Up through 24% Bracket, Age 93 (Max RMD):

Income = $25k + $25k + $64k + $126k (RMD) - $24k = $216k

Conclusion: It begins to get fuzzier here, since ~$50k of income is being pushed into the 24% bracket. But, that’s as compared to the 22% bracket (2% delta). I suppose in a scenario compared to the 12% bracket, the delta would be 10% but, that doesn’t seem reasonable, since we’re comparing it to the bracket we’d be doing conversions into - the 22% bracket. Since even this exaggerated scenario of $50k being pushed into a 10% higher bracket (22-12) still falls short of the $50k X 15% savings in #1 above, Roth conversions still don’t seem to be a winner.

OK, I know much of this rides on the return assumed. In today’s environment, I think 4% real for a 50/50 AA is very realistic. But, if we increase that from the 4% used above to 6%, I get the following results (big changes are RMDs so that’s what’s adjusted):

1. Same

2. 22% Bracket, Age 71:

Income = $25k + $25k + $64k + $96k (RMD) - $24k = $186k

Conclusion: Pushes $21k into a 2% higher bracket (24% vs 22%), which doesn’t equal the 15% savings on $50k for 13 years.

3. 24% Bracket, Age 96 (Max RMD):

Income = $25k + $25k + $64k + $261k (RMD) - $24k = $351k

Conclusion: Now we’re into brackets significantly above the 22% bracket we’d be doing early retirement Roth conversions in. The additional tax would be ($315k-$165k)(.24-.22) + ($351k-$315k)(.32-.22) < $4k/yr. Again, still not the $8k/yr benefit of capturing zero tax LTCG and, I hate the be the bearer of bad news but, with max RMDs at age 96, most of us will not have to worry about this trade off. But, it’s a good ‘worst case’ marker.

OVERALL CONCLUSION (and my advice to the Yorgs): Mr. & Mrs. Yorg should use their low income, pre-RMD early retirement years to capture LTCG before considering any Roth Conversions.

What would your advice be?

Question: Using the ‘prototypical E-R.org member, is it better to capture LTCG in the lower tax brackets of ER (ages 57-70ish) or to do Roth conversions?

Profile: Using info from recent polls & threads (Thx MidPack) plus some interpolation, we’ll use a prototypical “ERorg” member (we’ll call him “Yorg”):

Age=57, married

NW=$2.9M

AA=50/50 (earns 4%/yr real)

Asset Location=40% taxable/40% tax deferred/20% tax free

Annual Spend=$84k

WDR=3.4% ($99k)

Pension Income= $25k

SS=$64k/yr (assume maxed out, deferred to 70 & 1.5 times max earner)

Stipulations: (I think these are reasonable, and we need to prevent this from getting too complicated)

1. Nobody can tell the future so, we assume tax brackets will remain the same (posted at the bottom for easy reference)

2. Mr. & Mrs. Yorg will live to their actuarial ages because, again, nobody can tell the future [Note: this means that MFJ tax brackets apply for almost all years.]

3. Market returns will remain within historical ranges (ie: nothing crazy stupid outside typical secular bull/bear markets) because,...well, you know.

4. This analysis is relevant only for what we can choose to do in the ER years (57 - 70.5) because, that’s the only time one has the capacity to influence it with the methods being evaluated (how to best fill the various marginal tax buckets).

5. Mr. & Mrs. Yorg have no overriding legacy goals. [Note: Assuming otherwise could complicate this analysis significantly. So, for this analysis, please abide by this stipulation.]

6. Managing to ACA (or other income based) subsidies is not considered.

Discussion: (only the beginning I’m sure �� )

I’ve read many (most?) of the E-R.org threads on Roth conversions and, the consensus seems to be that it’s wise (ie: minimizes lifetime tax bite) to do Roth conversions up to the XX% bracket during the early retirement, low income, pre-RMD years. I’ve spent less time @ BH but, the consensus there seems to be the same. That makes intuitive sense to me but, when analyzing the sample situation, I just can’t get “Roth Conversions” to always be the best choice for for the “Yorgs.” I keep coming back to capturing zero tax LTCGs first.

To simplify all the ‘puts & takes’ of the various options, I chose a simple model (Complicated ones make my head hurt): In my model, I accept that the Yorgs have an existing tax liability and, if they do nothing, they will pay exactly those taxes for the remainder of their time, this is “neutral” (neither positive nor negative); I view this liability as a line from left to right with time on the horizontal axis (the line can be straight, rising or variable; whatever works for you but, it actually doesn’t make any difference). The Yorg’s goal is to be below the line, defined as avoiding their existing tax liability (saving spendable NW). So, if they save $5k in taxes in year one, they’re $5k ahead (“below the line”); do it again in year two & they’re $10k ahead, and so on.

So, I said I concluded that capturing zero tax LTCG is best for the Yorgs. Here’s how I concluded that. They can capture “X” LTCG (on top of any other income) up to ~$77k and avoid 15% of “X”; they’re now X(15%) below the line of their baseline tax liability. They could continue to do this for all the RE years until RMD time, and build up a substantial amount of tax avoidance (increased NW). What if they did a Roth Conversion instead? Using the new tax brackets below, I see they’d pay 11.5% on the conversion, meaning they’re (temporarily) X(11.5%) above the line. [Note: We know from Kitces & others that if marginal tax rates remain the same, this turns out to be a wash come RMD time. Remembering my stipulation #1 above, we’ll call Roth Conversion “a wash.”].

But, what about the fact that the Yorg’s marginal tax rate during RMD time will be higher than it is now? And, if they convert to Roths now, they’d avoid those taxes right? OK, let’s look at this. We now have a numerical target to determine if Roth Conversions are better; it’s X(15%) that we got from capturing zero tax LTCG. We’ll examine several tax bracket scenarios.

1. Up through 12% Bracket, Age 57-70:

Income = $25k (pension) + $25k (DVD + Int) - $24k (2 Deductions) = $26k

LTCG to fill 12% bucket:

Available headroom (rounding)= $77k - $26k = $51k

Savings = $51k(15%)=$8k

Roth Conversion to fill 12% bucket: Savings is zero (See above, it’s a wash)

Conclusion: filling bucket with LTCG is best choice

2. Up through 22% Bracket, Age 71:

Income = $25k (pension) + $25k (DVD + Int) + $64k (SS) + $73k (RMD) - $24k (2 Deducions) = $163k

Conclusion: Doing conversions (age 57-70) into the 22% bracket would save the Yorg’s nothing because they remain in the 22% bracket even with RMDs. Plus, they would have foregone the opportunity to capture zero tax LTCGs.

3. Up through 24% Bracket, Age 93 (Max RMD):

Income = $25k + $25k + $64k + $126k (RMD) - $24k = $216k

Conclusion: It begins to get fuzzier here, since ~$50k of income is being pushed into the 24% bracket. But, that’s as compared to the 22% bracket (2% delta). I suppose in a scenario compared to the 12% bracket, the delta would be 10% but, that doesn’t seem reasonable, since we’re comparing it to the bracket we’d be doing conversions into - the 22% bracket. Since even this exaggerated scenario of $50k being pushed into a 10% higher bracket (22-12) still falls short of the $50k X 15% savings in #1 above, Roth conversions still don’t seem to be a winner.

OK, I know much of this rides on the return assumed. In today’s environment, I think 4% real for a 50/50 AA is very realistic. But, if we increase that from the 4% used above to 6%, I get the following results (big changes are RMDs so that’s what’s adjusted):

1. Same

2. 22% Bracket, Age 71:

Income = $25k + $25k + $64k + $96k (RMD) - $24k = $186k

Conclusion: Pushes $21k into a 2% higher bracket (24% vs 22%), which doesn’t equal the 15% savings on $50k for 13 years.

3. 24% Bracket, Age 96 (Max RMD):

Income = $25k + $25k + $64k + $261k (RMD) - $24k = $351k

Conclusion: Now we’re into brackets significantly above the 22% bracket we’d be doing early retirement Roth conversions in. The additional tax would be ($315k-$165k)(.24-.22) + ($351k-$315k)(.32-.22) < $4k/yr. Again, still not the $8k/yr benefit of capturing zero tax LTCG and, I hate the be the bearer of bad news but, with max RMDs at age 96, most of us will not have to worry about this trade off. But, it’s a good ‘worst case’ marker.

OVERALL CONCLUSION (and my advice to the Yorgs): Mr. & Mrs. Yorg should use their low income, pre-RMD early retirement years to capture LTCG before considering any Roth Conversions.

What would your advice be?

Attachments

Last edited: