Archman

Recycles dryer sheets

- Joined

- Nov 19, 2010

- Messages

- 136

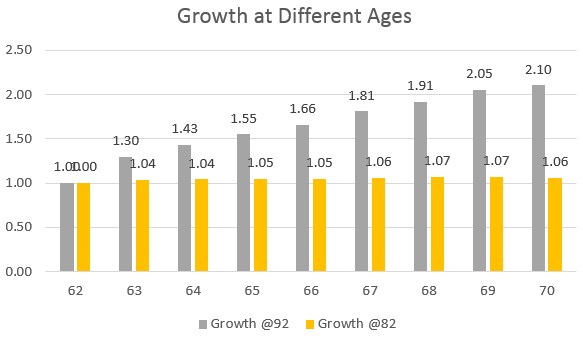

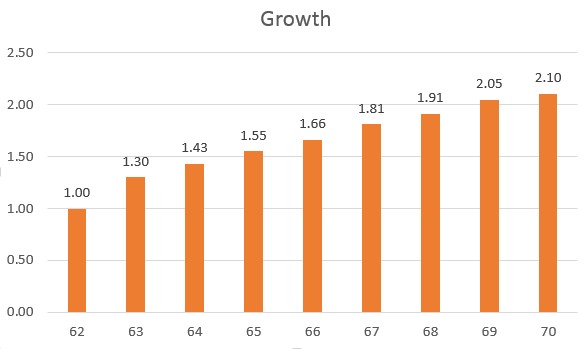

I thought I'd explore what taking SS at various ages would do to me. I took the results from the SS Benefit Calculator and plugged them into Fido's RIP. After running simulations it gave me the total assets at 'end of plan' , based on taking benefits each year from age 62 to 70. I divided each total by the first years total and plotted a graph:

Thus, if I wait until 70 to collect benefits, RIP calculates that my end of plan assets will be 2.1 times greater than if I collect them at 62.

I guess I'll be waiting!

Interesting. Your graph shows that assets at taking SS @66 are 1.28 times more compared to taking SS @63. Remember, I got 1.26 x using FireCalc