I would not be so scroogy to deny myself some materialistic pleasures. But I do not have snobby tastes, nor expensive habits. If my stash suddenly grows 2x, I would not spend 2x more, even though that still means a WR of 3.5%.

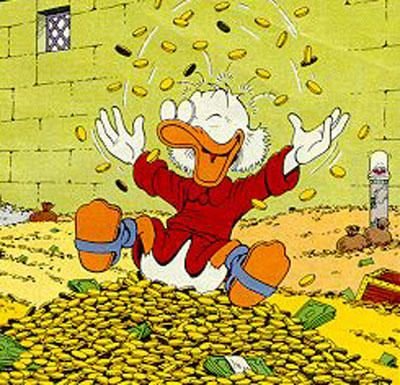

I can only eat, drink, or travel so much, so the pleasure that I can buy and consume is limited (one can spend a lot of money on luxurious and frivolous goods and services, but my nature will not let me enjoy that). On the other hand, my counting pleasure will be enhanced if I can ever get to a 8-figure portfolio. And I do not think I would be tired of counting money ever. The pleasure of consumption can get old and I get used to it, but the pleasure of counting money never ends, if you understand me.

And to see it shrinks, man, that will really hurt.