One thing to be aware of is that cancelling your Costco AMEX card will be a slight hit to your credit score. My Costco AMEX card is my second oldest card so the age of my credit history would go down, possibly reducing my credit score. Also, getting a replacement AMEX card would drop it. I ran it on a simulator and adding a new card dropped my score by 2 points. Unfortunately, I got a message that dropping my oldest card gave unusual results and to try again later.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Costco AMEX Replacement Card

- Thread starter TrvlBug

- Start date

I've always been concerned about opening and closing credit cards for that same reason. It's sort of a catch 22 situation. I don't need ANOTHER Visa card but at the same time I'd love to take advantage of the new AMEX $300. bonus offer.

Like many others here, I have a 800+ credit score and worked years to get it. Luckily between being newly retired and having a sizable net worth, my credit score isn't as important as it use to be.

I'd love to know exactly how these credit card changes actually affect credit scores for people like myself. I have a couple of credit cards I haven't used in years and would love to just get rid of them. With reward credit cards like they are now, most of us try to use just one card for everything along with keeping another as backup.

Like many others here, I have a 800+ credit score and worked years to get it. Luckily between being newly retired and having a sizable net worth, my credit score isn't as important as it use to be.

I'd love to know exactly how these credit card changes actually affect credit scores for people like myself. I have a couple of credit cards I haven't used in years and would love to just get rid of them. With reward credit cards like they are now, most of us try to use just one card for everything along with keeping another as backup.

How did you get 3% back at restaurants? The existing card only offers 2% back for dining, and the new card will offer the same.

Sorry. Wishful thinking. You're correct. 2%.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Sorry. Wishful thinking. You're correct. 2%.

The new card will give you the same benefit and be accepted at more places, so you aren't out anything. Might even be better for you!

Another Reader

Thinks s/he gets paid by the post

- Joined

- Jan 6, 2013

- Messages

- 3,413

I wonder if they will do hard pulls on credit to see if they want to keep you as a customer or offer you other products when they acquire the portfolio. Also makes me wonder if I might have signed my right to refuse this in a transfer of the card account portfolio.

Gotadimple

Thinks s/he gets paid by the post

- Joined

- Feb 17, 2007

- Messages

- 2,615

Citi has bought the entire portfolio. They are not assessing on a by-customer basis.I wonder if they will do hard pulls on credit to see if they want to keep you as a customer or offer you other products when they acquire the portfolio. Also makes me wonder if I might have signed my right to refuse this in a transfer of the card account portfolio.

- Rita

I've always been concerned about opening and closing credit cards for that same reason. It's sort of a catch 22 situation. I don't need ANOTHER Visa card but at the same time I'd love to take advantage of the new AMEX $300. bonus offer.

Like many others here, I have a 800+ credit score and worked years to get it. Luckily between being newly retired and having a sizable net worth, my credit score isn't as important as it use to be.

I'd love to know exactly how these credit card changes actually affect credit scores for people like myself. I have a couple of credit cards I haven't used in years and would love to just get rid of them. With reward credit cards like they are now, most of us try to use just one card for everything along with keeping another as backup.

Was in same situation. However, no big deal. Was in 800+, dropped to

700's. But I got a lot of "free" money when I took advantage of these

Credit Card promo's.

Got the bonus, then cancelled the card.

Added gift, these bonus' are Not Taxable !

dirt_dobber

Recycles dryer sheets

800+ here as well & I also don't care about credit scores - HOWEVER - they are used to determine so much I do care about.

The scores are used in determining...

Car and homeowner insurance rates.

When renting (I own but his could be a detriment to many ER's who don't own)

Buying a cell phone.

Some utility companies.

The scores are used in determining...

Car and homeowner insurance rates.

When renting (I own but his could be a detriment to many ER's who don't own)

Buying a cell phone.

Some utility companies.

Another Reader

Thinks s/he gets paid by the post

- Joined

- Jan 6, 2013

- Messages

- 3,413

Yes, they bought the portfolio. Like any purchase of accounts, the buyer hopes to make more money off the acquisition than the seller did and avoid losses from customers they don't want. I'm sure their software will be mining the customer data to see who is a valuable customer and who needs to be jettisoned. Just not sure if they acquired permission to pull credit American Express was granted when I opened the account.

Siestatime

Recycles dryer sheets

- Joined

- Jan 1, 2013

- Messages

- 63

In this process, Amex offered me a new "blue" credit card, then followed up with an offer of $200 if I just used the card for the first couple of months for $1000. This offer seemed too good to be true, but I tried it anyway, since I had a business trip coming up. Low and behold, they promptly gave me the $200.

Sent from my Nexus 4 using Early Retirement Forum mobile app

I got the same offer, and I assume all Costco members will do so too. My offer also promises 3% back on all grocery purchases, 2% back on gasoline purchases, and 1% back on all other purchases.

I'm just concerned about the impact of opening a new (BOA Visa) credit card for my Costco ID on my credit rating.

Sent from my iPad using Early Retirement Forum

Badger

Thinks s/he gets paid by the post

- Joined

- Nov 2, 2008

- Messages

- 3,411

Your latest responses are correct, I had the chance to talk to a Costco manager last night and he had just come from a meeting about this whole situation. He said:

1. ANYONE with a current AMEX Costco card will automatically be getting a new Citi Bank Visa card. Like it or not.

2. Once this new Visa card is activated your old AMEX card will no longer be active. Not even as an AMEX card at other places. Old card is completely closed. No longer will you have a AMEX account even if your card has a future expiration date on it.

3. The only way to not get the new Visa card is to cancel your AMEX card prior to the switch over.

4. Anyone canceling the AMEX card and not getting the new Visa one can simply go to Membership Services and have a new membership card made.

5. For anyone like me who already has a couple of Visa cards and doesn't want another, we need to cancel our AMEX account prior to the June switch over date. If we wish to continue with a new AMEX card, they are offering a new card with a $300. credit bonus after making a certain amount of purchases during the first 90 days.

6. For me, I just plan to use my BofA Travel Reward Visa card at Costco after all this happens.

I doubt it will work this way for those of us who have frozen our credit with the 3 bureaus.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

That will be interesting to see. There may be a loophole for someone buying an existing account. They aren't technically opening a new account.I doubt it will work this way for those of us who have frozen our credit with the 3 bureaus.

RetireAge50

Thinks s/he gets paid by the post

- Joined

- Aug 6, 2013

- Messages

- 1,660

Just changed all my automatic payments from Amex to PenFed. 5 minute job. Goodbye Amex.

Ronnieboy

Full time employment: Posting here.

- Joined

- Feb 14, 2008

- Messages

- 748

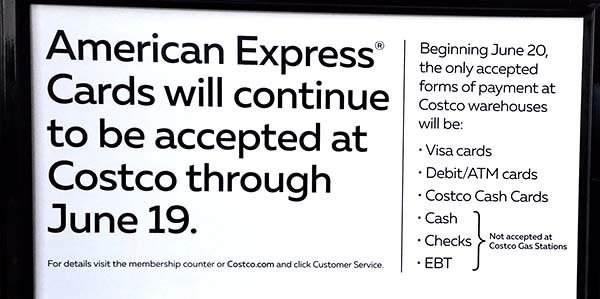

Looks like June 19th is the last day AMEX will be accepted at Costco AND Costco.com. Visa to start June 20th.

powerplay

Thinks s/he gets paid by the post

- Joined

- Oct 22, 2008

- Messages

- 1,608

Looks like June 19th is the last day AMEX will be accepted at Costco AND Costco.com. Visa to start June 20th.

Thanks! It's good to know the date for the change.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Is there a link to an announcement or press release or did you ask someone at Costco?Looks like June 19th is the last day AMEX will be accepted at Costco AND Costco.com. Visa to start June 20th.

Ronnieboy

Full time employment: Posting here.

- Joined

- Feb 14, 2008

- Messages

- 748

Is there a link to an announcement or press release or did you ask someone at Costco?

It was on the Costco Intranet, via someone at Costco.

Is there a link to an announcement or press release or did you ask someone at Costco?

Credit card transition

https://customerservice.costco.com/...it-Card-Transition-Visa-Citi-American-Express

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Thanks!

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

At the Costco fuel pumps today there was a sign that June 19th was the last day AMEX would be accepted. And VISA beginning Jun 20.

I don't think I'm going to be using the new Costco VISA other than paying for the annual membership fee. My PenFed 5% off will work at the Costco pumps starting June 20.

Maybe I'll try to get another Costco membership card so that I don't have to carry the credit card just to use as my entry ID.

I don't think I'm going to be using the new Costco VISA other than paying for the annual membership fee. My PenFed 5% off will work at the Costco pumps starting June 20.

Maybe I'll try to get another Costco membership card so that I don't have to carry the credit card just to use as my entry ID.

Attachments

misanman

Thinks s/he gets paid by the post

- Joined

- Apr 28, 2008

- Messages

- 1,252

I have the Penfed card but I thought there was a restriction on using it at places such as Costco -

There is only one credit card in America that offers no strings attached 5% cash back at any gas stations (excluding the likes of Costco) – the PenFed Platinum Cash Rewards Visa® Card.

Gotadimple

Thinks s/he gets paid by the post

- Joined

- Feb 17, 2007

- Messages

- 2,615

At the Costco fuel pumps today there was a sign that June 19th was the last day AMEX would be accepted. And VISA beginning Jun 20.

I don't think I'm going to be using the new Costco VISA other than paying for the annual membership fee. My PenFed 5% off will work at the Costco pumps starting June 20.

Maybe I'll try to get another Costco membership card so that I don't have to carry the credit card just to use as my entry ID.

Or just ask for a member ID without the credit card, I did that for years. I generally just use by Costco card for shopping in the store and at the gas pump. With Visa being accepted, unless there are better points on the Citi card, I'll switch to using my Visa card.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Yeah - that's what I'm going to do. I have my old one, but I wanted an executive member card. I asked for it when I upgraded a while back, and they told me just to use my AMEX card.Or just ask for a member ID without the credit card, I did that for years. I generally just use by Costco card for shopping in the store and at the gas pump. With Visa being accepted, unless there are better points on the Citi card, I'll switch to using my Visa card.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I have the Penfed card but I thought there was a restriction on using it at places such as Costco -

Oh right - that may be an issue. If so, we'll have to use the Costco card for gas there as that is our next best gas rewards card.

Although according to a commenter on nerdwallet.com who showed that same language, they get the 5% discount at Sam's Club gas stations, so I don't know why Costco would be different.

The only language I see (from my application) about gas on the card is

VISA USA determines which transactions are classified as gas purchases paid at the pump based on Merchant Category Codes. Fuel purchases for airplanes and boats do not receive cash back rewards.

I haven't been able to find PenFed language that excludes "warehouse" stations.

I have gotten full rewards from the gas pumps at my grocery store, and other grocery stores, and at Flying J.

Last edited:

walkinwood

Thinks s/he gets paid by the post

From Costco's site

[/FONT][FONT="] For more information on the new Visa credit cards as it becomes available, visit Costco.com and click Customer Service, or visit citi.com/WelcomeCostco (available starting March 24).

Similar threads

- Replies

- 33

- Views

- 5K

- Replies

- 32

- Views

- 845