SumDay

Thinks s/he gets paid by the post

- Joined

- Aug 9, 2012

- Messages

- 1,862

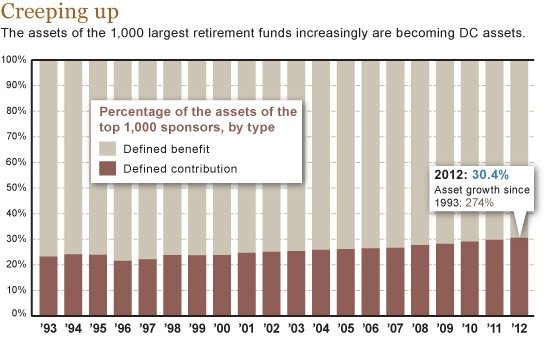

This is about Defined Contribution plans, not Washington, D.C. fyi.  Sorry, my job is in this line of work, so I just assume DC means the same thing to everyone. That's what I get for ASSuming....

Sorry, my job is in this line of work, so I just assume DC means the same thing to everyone. That's what I get for ASSuming....

http://www.pionline.com/article/20130204/PRINTSUB/302049974

For the first time, defined contribution plan assets make up more than 30% of the nation's 1,000 largest retirement funds' coffers and more than a quarter of the top 200 plans' assets, according to Pensions & Investments' annual survey.

http://www.pionline.com/article/20130204/PRINTSUB/302049974

Last edited: