Delawaredave5

Full time employment: Posting here.

- Joined

- Dec 22, 2004

- Messages

- 699

Spouse retiring at 58 with "same payment for life" base amount, no COLA.

There's an "income leveling option" where instead you can take 117% of base amount for 4 years, to 62, then take 93% of that base amount for rest of your life.

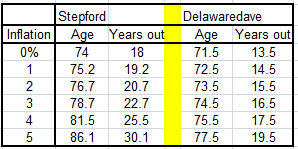

With no time value of money, the payback period is about 14 years. Assuming a 3% discount rate annually on the cash flows, the payback period is about 16 years.

Female life expectancy at 58 is 26 years. So with no known health issues and no "crystal ball", it would seem that taking the 100% base amount forever option (not taking the "juiced up" 117% first 4 years) would be best ?

Just not sure how "opportunity cost" and taxes factor. All payments would be taxed each year (40% state and federal), and before tax return assumption would be about 5% for a blended stock/bond portfolio.

Appreciate any thoughts............

There's an "income leveling option" where instead you can take 117% of base amount for 4 years, to 62, then take 93% of that base amount for rest of your life.

With no time value of money, the payback period is about 14 years. Assuming a 3% discount rate annually on the cash flows, the payback period is about 16 years.

Female life expectancy at 58 is 26 years. So with no known health issues and no "crystal ball", it would seem that taking the 100% base amount forever option (not taking the "juiced up" 117% first 4 years) would be best ?

Just not sure how "opportunity cost" and taxes factor. All payments would be taxed each year (40% state and federal), and before tax return assumption would be about 5% for a blended stock/bond portfolio.

Appreciate any thoughts............