Focus

Full time employment: Posting here.

- Joined

- Oct 10, 2009

- Messages

- 640

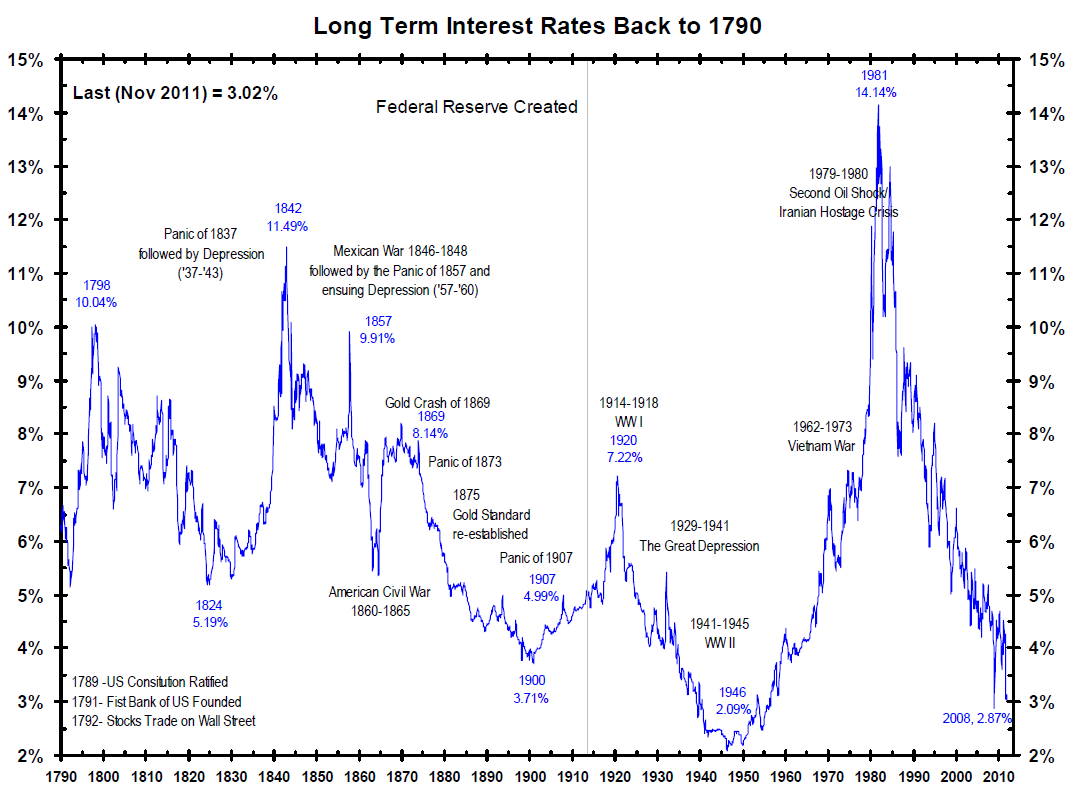

I have a stable value fund ready and waiting in case rates actually start to move higher. But I have no intention of making that move in anticipation of a rate increase that nobody really knows when or if it will occur.

I hear ya. For a while there, I kept my fixed income portion split between the stable value fund in my Vanguard 401(k) and the total bond fund. But when it became clear the consensus regarding an interest rate rise was wrong and the stable value fund (which has a higher expense ratio) dropped below a 2% return, I went back to 100% in the total bond fund.