ArkTinkerer

Full time employment: Posting here.

- Joined

- Aug 12, 2014

- Messages

- 584

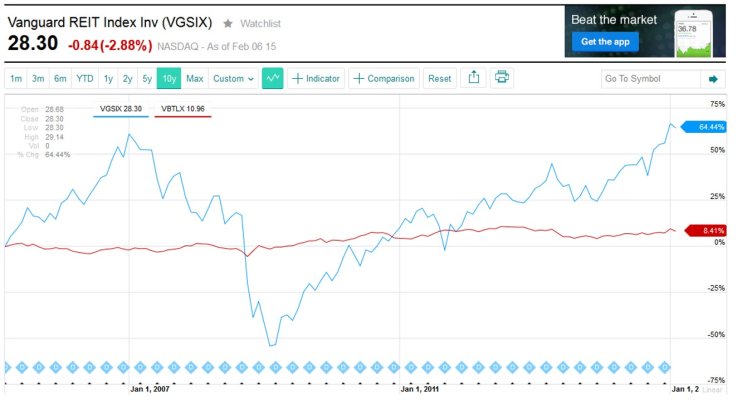

I keep looking at the sorry returns on most bonds and find myself wondering if they still make sense. The bond funds that seem to have any return are either hedging or dealing in junk bonds. At least that is the way it appears to me. I've never been a great fan of bonds. I did some Ibonds for the kids educational funds but even those seem to have really poor returns these days. I think they even went negative for a while.

I have some rental and investment property. Most of it either continued up, or held stable during the housing bubble. I admit that is mostly the luck of location but I think real estate in my area is pretty stable compared to the trendy coasts. Farmland is appreciating at a good clip as far as I can tell.

What are your views on bonds? Is it reasonable to replace bonds with real estate in a portfolio or do you view these as too different to sub for one another?

I have some rental and investment property. Most of it either continued up, or held stable during the housing bubble. I admit that is mostly the luck of location but I think real estate in my area is pretty stable compared to the trendy coasts. Farmland is appreciating at a good clip as far as I can tell.

What are your views on bonds? Is it reasonable to replace bonds with real estate in a portfolio or do you view these as too different to sub for one another?