Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

This interview with Laslo Birinyi worries me because I agree with Birinyi. Link: Birinyi

I'm guilty of liking the guy who is an old timer on Wall St. and appeared regularly on Wall St. Week years ago. He has a great gravelly voice too.

I'm guilty of liking the guy who is an old timer on Wall St. and appeared regularly on Wall St. Week years ago. He has a great gravelly voice too.

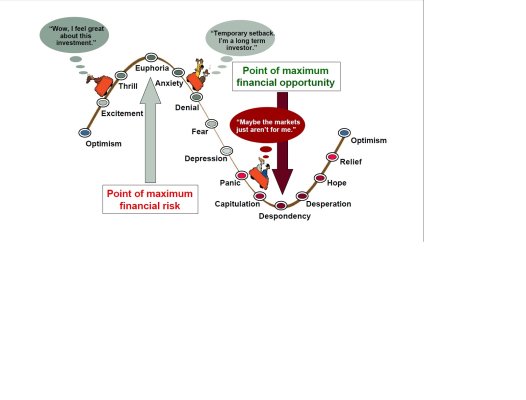

Yes, I know nobody can predict the future stock market but investors do seem to go through phases and business cycles do seem to exist.He says bull markets go through four phases of sentiment: reluctance, digestion or consolidation, acceptance, and finally exuberance. Of course, you can’t precisely measure those phases until the bull market is over, but Birinyi says the current bull entered phase four in July 2012. Since then, the S&P has risen 22%.

The “exuberance” has a funny way of showing itself — Consensus Inc.’s Bullish Sentiment index of professional investors has fallen to 50% from 67% in early August, while the American Association of Individual Investors’ poll last week showed a narrow 35%-31% split between bulls and bears.