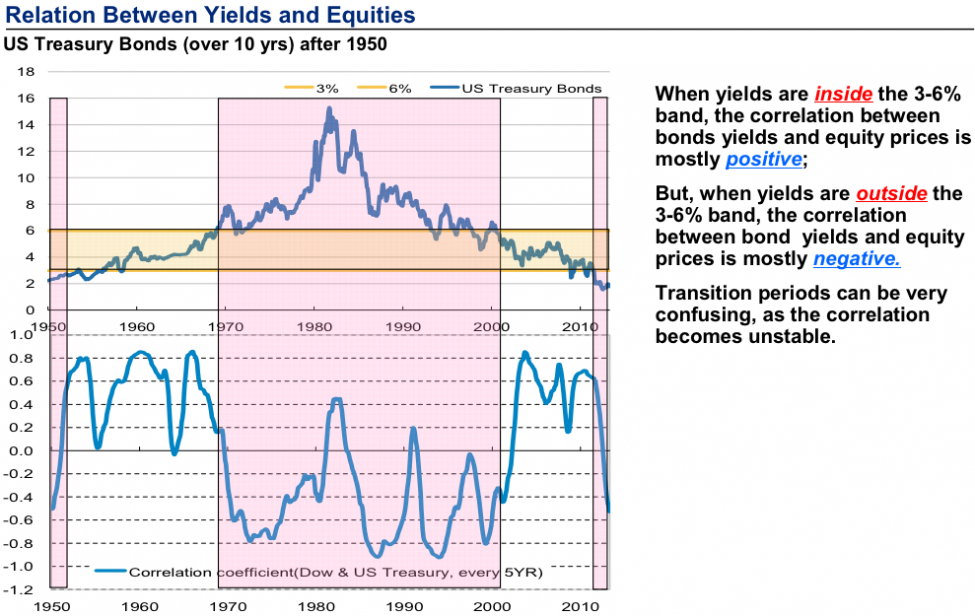

It's more complicated than that. You can choose to hold indiv long bond to maturity, but in rising rate environment the real principle value (actual purchasing power) will be prob be lessened by accompanying inflation. Although there are some bond funds with 'hold to maturity' style, most LT bond funds have significant turnover. They will have at least some capital losses under rising rate conditions as funds managers sell off some older issues to buy newer higher yielding bonds. The extra interest from those newer bonds would help offset at least some of the capital losses. In past rising rate periods, folks have usu done OK (not great) in good quality LT bond funds IF they held for # yrs approximating the fund's effective duration.

FWIW, I favor short duration bonds/funds right now as I expect rates to rise & have no idea how tapering by the Fed (& Europe, Japan, etc.) will affect the bond markets. Coming months/yrs could go smoothly....or get rather ugly