We’ve already spent $148 billion to bail out Freddy Mac and Fannie Mae. They now project another $90B under their baseline scenario. Their best case is just a little less, and their worst case is another $125B – additional to the $90B.

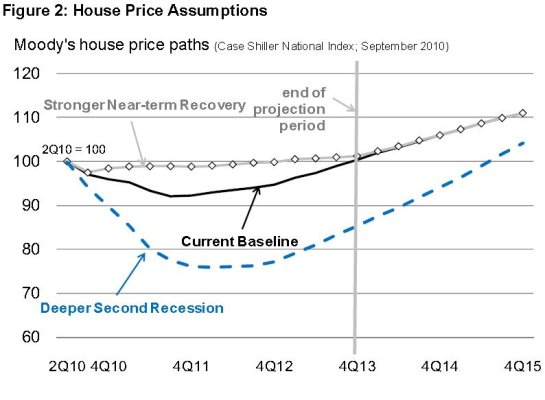

The baseline assumes housing prices decline another 7% through the end of next year, then recover slowly, getting back to current (2Q 2010) levels in 4Q 2013.

We hear some criticism of the GSEs and our housing policy, but not much. One would think that it would be a much greater election issue, but it isn’t. This is because both Freddie Mac and Fannie Mae have been among the largest donors and lobbyists, spending tens of millions every year. Taxpayer money to donate to and lobby politicians.

What a gravy train.

The baseline assumes housing prices decline another 7% through the end of next year, then recover slowly, getting back to current (2Q 2010) levels in 4Q 2013.

We hear some criticism of the GSEs and our housing policy, but not much. One would think that it would be a much greater election issue, but it isn’t. This is because both Freddie Mac and Fannie Mae have been among the largest donors and lobbyists, spending tens of millions every year. Taxpayer money to donate to and lobby politicians.

What a gravy train.

Report http://www.fhfa.gov/webfiles/19409/Projections_102110.pdfThe Federal Housing Finance Agency (FHFA) today released projections of the financial performance of Fannie Mae and Freddie Mac (the Enterprises) including potential draws under the Preferred Stock Purchase Agreements (PSPAs) with the U.S. Department of the Treasury. To date, the Enterprises have drawn $148 billion from the Treasury Department under the terms of the PSPAs. Under the three scenarios used in the projections, cumulative Enterprise draws range from $221 billion to $363 billion through 2013.