mathjak107

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 27, 2005

- Messages

- 6,208

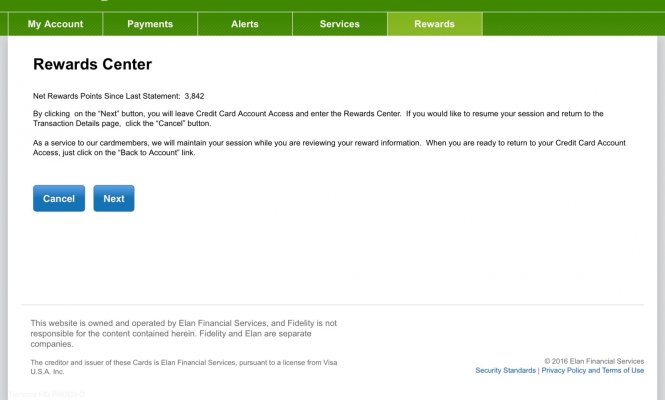

Sure, that's easy. But we were discussing how to get the activity into Fidelity Full View. In order to do that, you have to set up a separate login at Elan Cardmember Services. Then add the account(s) to Fidelity Full View, same as any other external account.

I was a little confused on dates, so I just read the website and FAQ. It says you can use the old card through July 22. On July 23, the old accounts will be closed and you will no longer have access to the FIA website. July 26 is the date they transfer balances, rewards, and transaction history to the new accounts, which will be available to customers via the Elan website July 27.

Also saw this in the FAQ which is pertinent to the OP and consistent with what I was told earlier by an Elan rep:

i tried quicken years ago . it was to much work so i dropped it .

i like simple and full view is as simple as you can get since except for the link to external accounts there is nothing left to do to see spending at a glance .

i am lazy when it comes to tracking and coding the things full view does not automatically code but then again i don't really care what we spent on what . i would only care if we had to make cuts which we don't , we came in under what our goal posts are . so as long as we are under budget , what went where is not a concern . i would do it all again the same way anyway .