nvestysly

Full time employment: Posting here.

- Joined

- Feb 19, 2007

- Messages

- 599

I began to log in to my Fidelity account today and saw the quip shown below on their home screen:

From our experts

How much to retire?

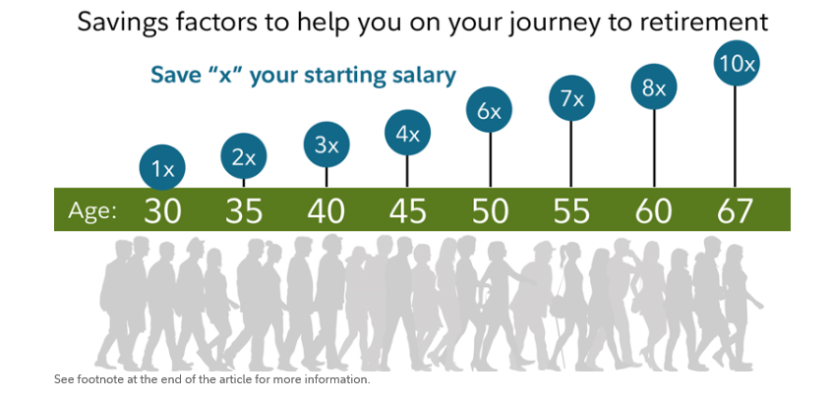

Fidelity's rule of thumb: Try to save 10x your income by age 67

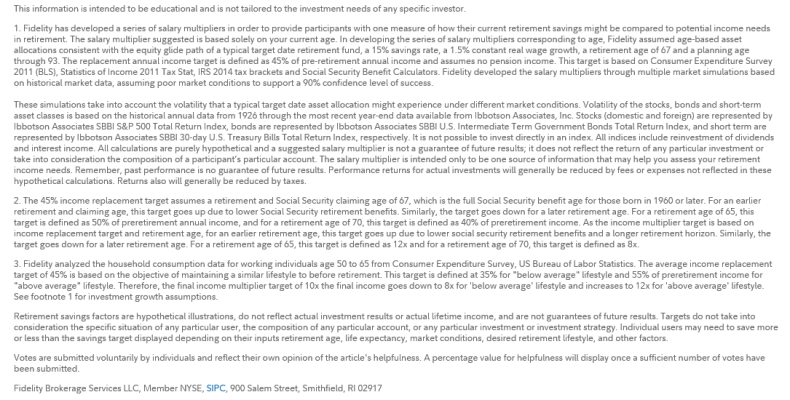

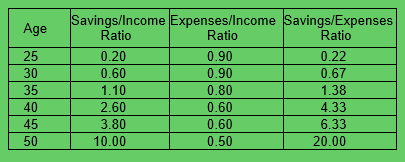

I continue to be amazed at how few financial planners/brokers/etc. want to talk about expenses. Yes, there are lots of ways to slice and dice the subject and at a young age you really have no idea what your expenses will be later in life. But come on Fidelity... Really? Is this the kind of advice that gives people a warm and fuzzy feeling? I guess it provides a goal - a target - and if you don't have any target this is better than nothing.

The problem is (and I'm preaching to the choir) income has very little to do with the matter at hand. If you're living off a small fraction of your income then 10x your income may be overkill in a big way. If you're maxing out expenses and spending every penny then 10x is not enough. If you're living way beyond your means and in over your head in debt then 10x won't be nearly enough!

Argghhhh! I'm a longtime Fidelity customer and will continue to use their services. Fortunately I don't need their retirement "advice."

From our experts

How much to retire?

Fidelity's rule of thumb: Try to save 10x your income by age 67

I continue to be amazed at how few financial planners/brokers/etc. want to talk about expenses. Yes, there are lots of ways to slice and dice the subject and at a young age you really have no idea what your expenses will be later in life. But come on Fidelity... Really? Is this the kind of advice that gives people a warm and fuzzy feeling? I guess it provides a goal - a target - and if you don't have any target this is better than nothing.

The problem is (and I'm preaching to the choir) income has very little to do with the matter at hand. If you're living off a small fraction of your income then 10x your income may be overkill in a big way. If you're maxing out expenses and spending every penny then 10x is not enough. If you're living way beyond your means and in over your head in debt then 10x won't be nearly enough!

Argghhhh! I'm a longtime Fidelity customer and will continue to use their services. Fortunately I don't need their retirement "advice."