Using a 60/40 port Firecalc says our 100% SWR = 3.42% for 39 years. If we use a 40/60 port our SWR = 3.24%.

Would it be wise to cut back our volatility risk (a la Bernstein's "you already won the retirement game") for 18bps of SWR cost?

We really like the 60/40 allocation emotionally. But rationally is it a good choice? We have the experience of 3 nasty bear markets so we have good risk tolerance and "strong hands".

While I think these historical reviews are a good starting point, I doubt you can realistically count on the future worst case to be so identical to past worst case to split hairs over 18 basis points.

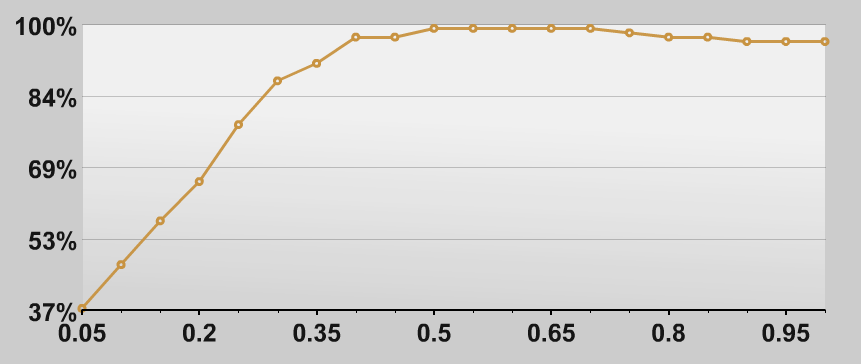

I look more at general trends, and a 40/60 is getting closer to the knee where success drops pretty fast. For 39 years, and a 3.5% WR, that knee is at about 35%, but is pretty flat all the way to 100% equities. For that reason, I prefer to move more towards the middle of the curve.

As far as volatility, if you were Ok in the last bears, how bad is 60/40 versus 40/60? Look at it this way - if that was a $1M portfolio, and equities took a 50% drop (pretty extreme) and assume fixed maintained its value:

A 60/40 would now by $300K + $400K = $700K

A 40/60 would now by $200K + $600K = $800K

Significant, but not crazy different, IMO.

And the thing that people mostly ignore when they focus on a historically large market drop is that drops like that

come after a run up. And if you had higher equity AA all along, that drop would have occurred

from a higher level to begin with. It isn't apples-apples to only look at the drop with a given AA, you need to look at what led up to it.

-ERD50

edit/add: 1,000 words