Ed_The_Gypsy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I am not sure this update has been reported here yet.

As reported here earlier, on Dec 28 of last year, in his blog Can I Retire Yet New Research: The Best Retirement Withdrawal Strategies - Can I Retire Yet?, Mr. Kirkpatrick posted the results of his search for the best retirement withdrawal strategies. He found that for an initial 50/50 AA, an annual 4%+inflation withdrawn in equal amounts from stocks and bonds for 30 years had superior survivability and terminal value to all but one of his schemes. It was so simple and the relative success was so striking to me.

Mr. K has just posted the results of a further study in his blog of March 8 The Best Retirement Withdrawal Strategies: Digging Deeper - Can I Retire Yet? (also reported in Yahoo Finance/Money Magazine, but the post in his blog is more informative). I found the new results even more interesting. He discarded some of the earlier schemes as not worth further investigation and corrected some small errors. He then examined several withdrawal strategies with and without annual rebalancing for different AA’s--80/20, 60/40, 50/50, 40/60 and 20/80—using the usual data from 1928 to 2014.

Now some interesting stuff:

He found that all of his withdrawal strategies had at least 90% survivability until the AA dropped to 50% stocks and at least 80% survivability until stocks dropped to 20%.

Again, his CAPE withdrawal strategy came out on top but he acknowledged a comment that his use of CAPE required advance knowledge. In other words, he was applying CAPE averages from 1928 to 2014 to all tests, not looking backwards only. He says he may test backwards-looking-only CAPE averages. His method requires knowledge of the current value of CAPE, which may not always be easy to find. I am thinking of my surviving spouse or myself when the gears get rusty. He also states that market timing has been thoroughly debunked, but his CAPE strategy seems to me to be a kind of market timing.

The second runner-up again is what he now calls Proportional, whether or not the AA is rebalanced annually. Assets are harvested in proportion to the original AA. This is again wonderfully simple and I find it extremely attractive.

He found that annual rebalancing reduced volatility and also reduced the ending portfolio value. No surprises there. Take your choice. I prefer less volatility.

He observed that having a cash bucket is really part of AA and does not add anything. He noted earlier that he sells assets and takes withdrawals as he needs them (presumably monthly?), but he has also said that he personally is comfortable with a years’ cash in the bank. For his studies, he took distributions at the first of the year and rebalanced to the original AA at the end of the year when rebalancing was the option. (Note that he has a withdrawal strategy he calls Rebalancing which is not exactly rebalancing to the original AA. Beware. What he means is that he sells assets to try to bring the AA closer to the original AA but does not sell any more than the annual distribution requires so the post-withdrawal AA may not wind up equal to the original AA. This is to minimize transactions in your account. Clever! Aside from this, it does not appear to have any advantage over Proportional.)

This study looks worthwhile putting in FAQs as a sticky. Does anyone agree?

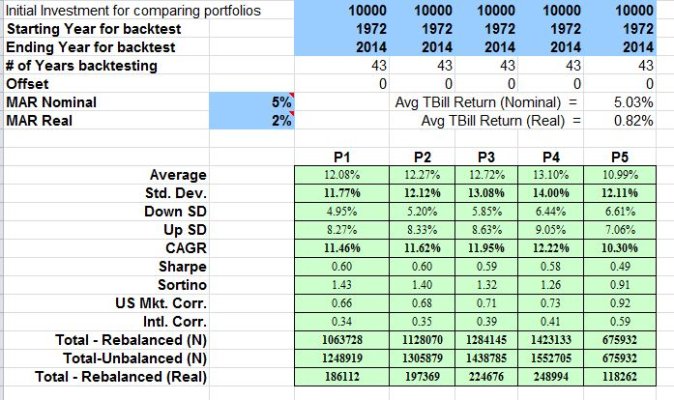

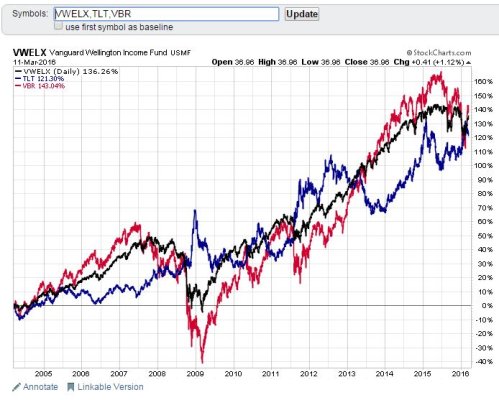

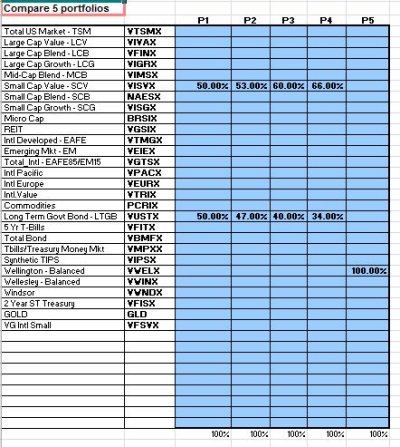

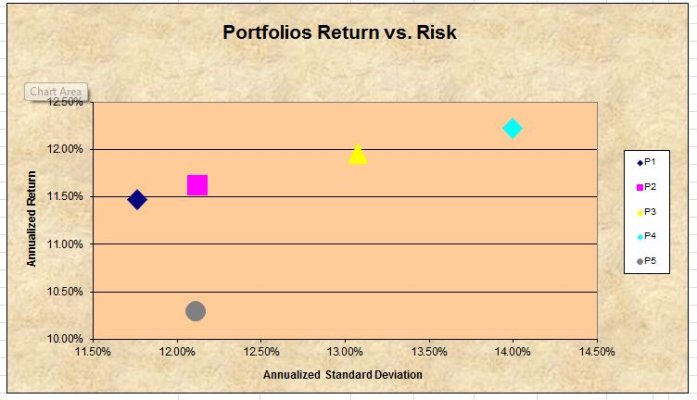

I have turned most of my AA to cash for the purpose of converting my TIRA to a Roth before MRD hits me so I have not committed to a future AA yet. I have in mind a 2:1 ratio of VRB/TLT (SCV/LTB), or 66%/34% because it is simple, does not require reference to an external number and dodges the market-timing issue. Paul Merriman has recently opined that one may as well choose SCV for the only equity class. I do plan to take a maximum 3.5% or 4% flexibly with no adjustment for inflation (another external number—still trying to keep it simple). A few months ago, I used data back to 1974 (IIRC) and it looks like annually rebalanced SCV/TLT (50/50 or 60/40) has better performance and less volatility than VWELX (Wellington, approx 60/40), my current standard. Wow. For myself, I have been taking distributions only as needed, a month at a time.

As reported here earlier, on Dec 28 of last year, in his blog Can I Retire Yet New Research: The Best Retirement Withdrawal Strategies - Can I Retire Yet?, Mr. Kirkpatrick posted the results of his search for the best retirement withdrawal strategies. He found that for an initial 50/50 AA, an annual 4%+inflation withdrawn in equal amounts from stocks and bonds for 30 years had superior survivability and terminal value to all but one of his schemes. It was so simple and the relative success was so striking to me.

Mr. K has just posted the results of a further study in his blog of March 8 The Best Retirement Withdrawal Strategies: Digging Deeper - Can I Retire Yet? (also reported in Yahoo Finance/Money Magazine, but the post in his blog is more informative). I found the new results even more interesting. He discarded some of the earlier schemes as not worth further investigation and corrected some small errors. He then examined several withdrawal strategies with and without annual rebalancing for different AA’s--80/20, 60/40, 50/50, 40/60 and 20/80—using the usual data from 1928 to 2014.

Now some interesting stuff:

He found that all of his withdrawal strategies had at least 90% survivability until the AA dropped to 50% stocks and at least 80% survivability until stocks dropped to 20%.

Again, his CAPE withdrawal strategy came out on top but he acknowledged a comment that his use of CAPE required advance knowledge. In other words, he was applying CAPE averages from 1928 to 2014 to all tests, not looking backwards only. He says he may test backwards-looking-only CAPE averages. His method requires knowledge of the current value of CAPE, which may not always be easy to find. I am thinking of my surviving spouse or myself when the gears get rusty. He also states that market timing has been thoroughly debunked, but his CAPE strategy seems to me to be a kind of market timing.

The second runner-up again is what he now calls Proportional, whether or not the AA is rebalanced annually. Assets are harvested in proportion to the original AA. This is again wonderfully simple and I find it extremely attractive.

He found that annual rebalancing reduced volatility and also reduced the ending portfolio value. No surprises there. Take your choice. I prefer less volatility.

He observed that having a cash bucket is really part of AA and does not add anything. He noted earlier that he sells assets and takes withdrawals as he needs them (presumably monthly?), but he has also said that he personally is comfortable with a years’ cash in the bank. For his studies, he took distributions at the first of the year and rebalanced to the original AA at the end of the year when rebalancing was the option. (Note that he has a withdrawal strategy he calls Rebalancing which is not exactly rebalancing to the original AA. Beware. What he means is that he sells assets to try to bring the AA closer to the original AA but does not sell any more than the annual distribution requires so the post-withdrawal AA may not wind up equal to the original AA. This is to minimize transactions in your account. Clever! Aside from this, it does not appear to have any advantage over Proportional.)

This study looks worthwhile putting in FAQs as a sticky. Does anyone agree?

I have turned most of my AA to cash for the purpose of converting my TIRA to a Roth before MRD hits me so I have not committed to a future AA yet. I have in mind a 2:1 ratio of VRB/TLT (SCV/LTB), or 66%/34% because it is simple, does not require reference to an external number and dodges the market-timing issue. Paul Merriman has recently opined that one may as well choose SCV for the only equity class. I do plan to take a maximum 3.5% or 4% flexibly with no adjustment for inflation (another external number—still trying to keep it simple). A few months ago, I used data back to 1974 (IIRC) and it looks like annually rebalanced SCV/TLT (50/50 or 60/40) has better performance and less volatility than VWELX (Wellington, approx 60/40), my current standard. Wow. For myself, I have been taking distributions only as needed, a month at a time.

Last edited: