meierlde

Thinks s/he gets paid by the post

If you believe the Great Wave (David Hackett Fisher) https://willrwright.wordpress.com/2...art-i-the-great-wave-by-david-hackett-fisher/

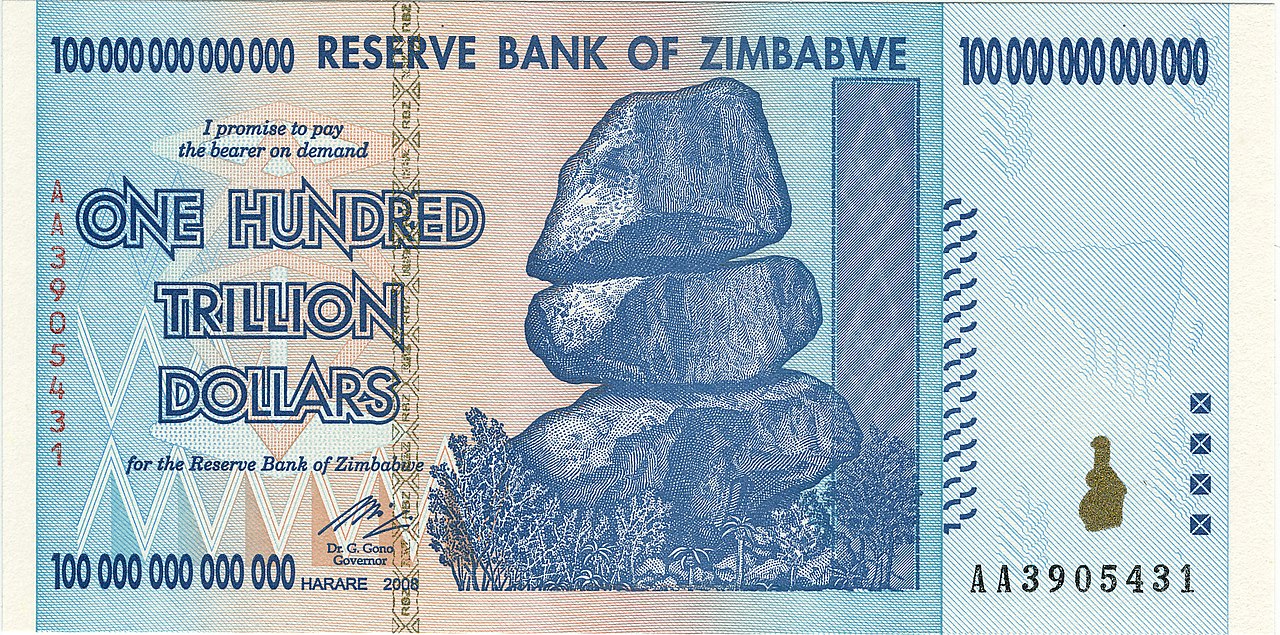

Inflation requires a growing population to go high. We note that Japan has had a long period of deflation and a shrinking population.

Hackett Fishers says population growth leads to money supply growth, as prices for necessities begin to rise (food fuel housing etc) Then the standard of living of the poor begins to decrease, and this leads to a decline in population growth and thus a decrease in demand for food fuel housing which means they become cheaper. This then leads to decreases in inequality which rose during the period of inflation.

While not all things seem to match given that we have passed thru a period of rapid population growth, and now are seeing a slowing of it, and now commodities in general have crashed (oil, copper, grains etc). It seems that we might be on the verge of a price stability period. Just like no one expected the high inflation of the 60s 70s and 80s, few seem to expect the potential low inflation period we are entering.

Given how hard it is for the fed to get inflation to 2% the deflation in Japan, the coming population shrinkage in China, etc, I do wonder if a lot of folks are relying on recent experience to predict the future?

Inflation requires a growing population to go high. We note that Japan has had a long period of deflation and a shrinking population.

Hackett Fishers says population growth leads to money supply growth, as prices for necessities begin to rise (food fuel housing etc) Then the standard of living of the poor begins to decrease, and this leads to a decline in population growth and thus a decrease in demand for food fuel housing which means they become cheaper. This then leads to decreases in inequality which rose during the period of inflation.

While not all things seem to match given that we have passed thru a period of rapid population growth, and now are seeing a slowing of it, and now commodities in general have crashed (oil, copper, grains etc). It seems that we might be on the verge of a price stability period. Just like no one expected the high inflation of the 60s 70s and 80s, few seem to expect the potential low inflation period we are entering.

Given how hard it is for the fed to get inflation to 2% the deflation in Japan, the coming population shrinkage in China, etc, I do wonder if a lot of folks are relying on recent experience to predict the future?